The tax disadvantages of living and working in Philadelphia are lessening.

Torey is Founder & Leader of URBN HMES: A client focused real estate experience that blends conventional principles with modern lifestyle to ensure comfort and optimal performance in a constantly changing marketplace.

- - -

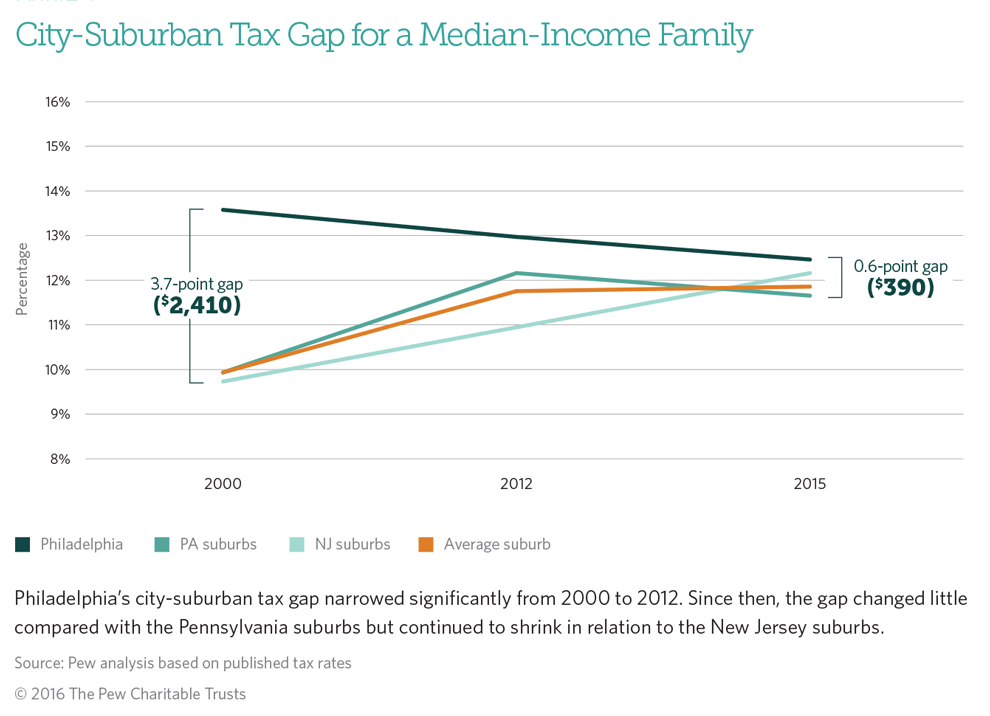

Recently another study from Pew Charitable Trusts was released. This study examined the tax-competitiveness of Philadelphia vs the surrounding suburbs, and the results bode well for Philly.

The main details from the report were:

- In 2000, the average gap between the city and suburbs was 3.7 percentage points. In dollar terms, adjusted for inflation, the family went from saving an average $2,410 in taxes in 2000 by living and working in the suburbs to saving just $390 in 2015.

- Suburban residents who work in Philadelphia had the worst tax situation. A family earning its income in the city and owning a home in the suburbs instead of Philadelphia saved about $300 in 2000 but lost $1,210 in 2015.

What does this mean for you Philadelphia?

This is yet another indicator of progress for the city. Although the city and its policies are far from perfect, this is just one more complaint that people make against living in the city that is losing its relevance. The growth of this city is inevitable. Now you need to ask yourself, are you a part of it?

If you like the insight in this article, don’t forget to show me some love and subscribe to my YouTube Channel or leave a comment with your feedback.

Thanks for your time :) If you found value in this article, hit that heart button below. It means a lot to me and it helps the rest of the world see this story.