If you’re thinking of buying a home, one of the first questions you may ask is “Can I qualify for a home mortgage loan?” There are a number of factors that determine the answer, such as your employment history (including length of time at your current job), your debt to income ratio (how much you owe compare to how much you make), and the amount you have for a down payment. But perhaps the biggest factor in determining your loan eligibility is your credit score.

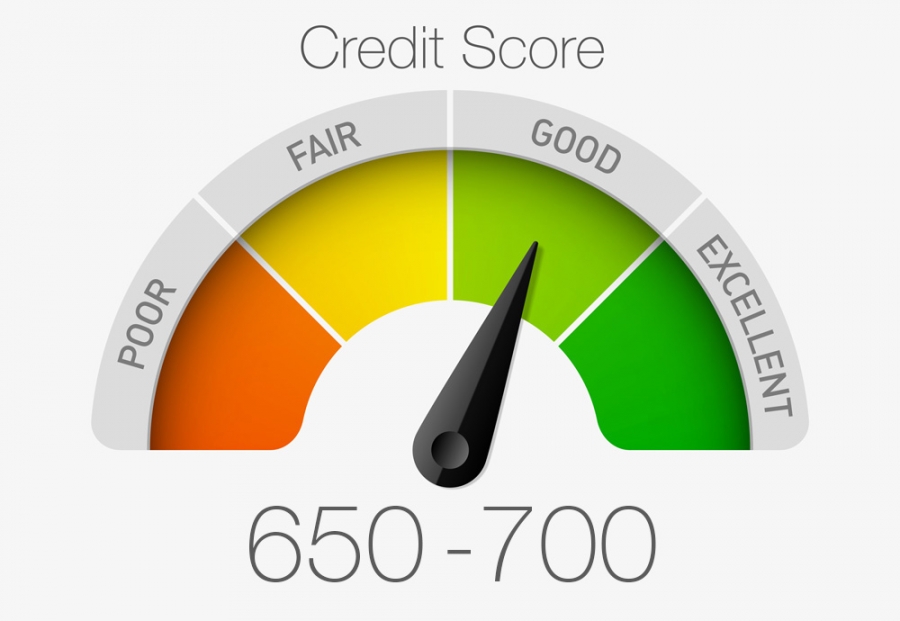

There are actually a few different types of credit scores. The score used by the mortgage industry is your FICO score, which for housing loans ranges from 300-850. This range is broken into categories ranging from “Excellent” to “Bad.”

The obvious question is “what credit score is needed to buy a house?”

Unfortunately, the answer isn’t as obvious.

According to Experian, one of three major credit reporting agencies in the U.S., the minimum credit score needed to buy a house is determined by the lender. Different lenders have different levels of risk tolerance and set different criteria, along with different cutoff points for the minimum credit score they are willing to accept.

The Lenders Network reports that the typical minimum FICO scores vary by mortgage type as follows:

- FHA Loans – 580+ credit score (500-579 score is possible but unlikely)

- VA Loans – 620+ credit score (some lenders require 580)

- USDA Loans – 640+ credit score

- FHA 203K Loans – 620+ credit score

- Conventional Loans – 620+ credit score

So although 580 is considered a “Poor” credit score, you may still qualify for a home loan, although you’ll be limited to an FHA Loan. The good news is that FHA Loans also allow down payments as low as 3.5%. The bad news is that you’ll likely end up paying more in the long run due to the FHA’s mortgage insurance requirements.

In general, if you have a FICO credit score of 640 or higher, you’re probably in good standing to get a mortgage loan, depending on the factors mentioned above. Interestingly, the average credit score for homebuyers in the first quarter of 2017 was 741, according to CoreLogic. So while those with lower credit scores can qualify for a mortgage loan, you’ll be more attractive to lenders – and get a better interest rate – if you have a higher score.

How to improve your credit score

If your credit score is in the “Poor” or “Fair” range, you may want to try to increase it before applying for a home loan. Your credit score is a combination of several factors:

- Payment history — 35%

- Amounts Owed — 30%

- Length of credit history — 15%

- Credit mix — 10%

- New credit / credit inquiries — 10%

When it comes to increasing your credit score, there are do’s and don’ts that apply across the board.

DO make all payments on time, every time

DO pay down credit card and loan balances

DO check your credit report (not just the score, the actual report) and dispute any errors

DO pay off past due balances and negotiate a “pay for delete” agreement with any balances reported by collection agencies (i.e., if you pay the balance, they remove the black mark from your report)

DO include your rental history on your credit report

DO become an authorized user on a family member’s credit card account (but only if they have an excellent payment history)

DON’T close old accounts in good standing (it will lower your debt to credit ratio which typically needs to be above 30%)

DON’T open new accounts just to get a different credit mix or to get more credit

DON’T let old credit cards languish to the point the company closes your account (make a small purchase that you pay off right away to keep the card active)

DON’T take out a loan or co-sign a loan for a major purchase

DON’T miss payments on your business credit card if you’re the business owner

In addition to these do’s and don’ts, there are several recent developments in the mortgage loan industry that may work in your favor to increase your credit score.

This summer, HousingWire reported that lenders have eased mortgage credit standards recently (making it easier to qualify for a loan). They also expect further easing in the coming months.

Additionally, Fannie Mae (FNMA) and Freddie Mac (FHLMC) recently raised the debt-to-income ratio limit for borrowers to 50 percent of pretax income, up from 45 percent.

And starting July 1, Equifax, Experian, and TransUnion stopped allowing tax lien and civil judgment records to appear on credit reports if the claim lacks the person’s name, address, Social Security number, or date of birth. Given that up to 25% of people find errors on their credit reports, and that a large percentage of these errors involve unpaid taxes (tax liens) or civil judgements, the new policy is expected to raise the credit scores of about 12 million Americans by as much as 20 points.

How to check your credit score

You can get a free copy of your credit report from each of the three credit reporting agencies once a year (every 12 months). Visit annualcreditreport.com or call 1-877-322-8228. The free report does not include your FICO credit score.

There are several websites that offer to reveal your current credit score at no charge. Just be sure to read the fine print as you may actually be signing up for a free trial of a credit monitoring service that will bill you monthly down the road. Also, many of these sites reveal your VantageScore, not your FICO score, which is a slightly different method of calculating credit scores. Earlier this year, DiscoverCard launched a free service that provides FICO scores.

When it comes to qualifying for a home loan, there are many variables and many types of mortgage loans to choose from, even if you are credit challenged. So don’t give up on the dream of homeownership simply based on your score. Work with a mortgage broker to understand what options you have, and take positive steps to improve your credit score in the meantime.

This post originally appeared on the Housefax blog.