Graduating from college can open the door to new career and financial opportunities. It can also leave you with a large amount of debt, making it difficult to qualify for a loan. Fortunately, it is possible to get a mortgage even while you are still paying off student loans.

Image via Flickr by cafecredit

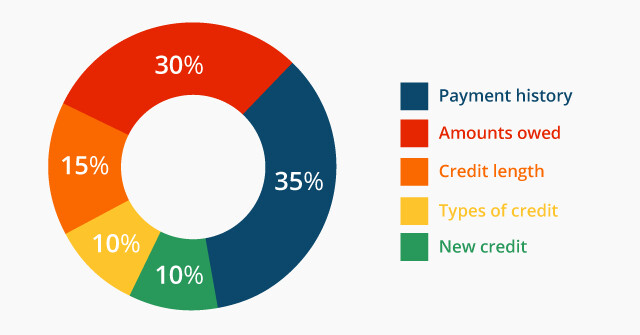

While your credit score is important to qualify for a vehicle or personal loan, your FICO score is what your mortgage eligibility is based on. Your Fair Isaac Corporation (FICO) is calculated by combining your payment history, amount of debt, history of credit, new credit in account, and the different types of credit used.

Although a large amount of student debt could penalize you in terms of your amount of debt, you can make up for it in other criteria areas. In some cases, student loans can actually give you a minimal boost because they give you a greater length of credit history. You can maintain a good FICO score by making payments on time, paying down other debts, and avoiding opening up too many new credit accounts.

Purchase a Fixer-Upper

It is possible to get qualified for a mortgage even with a large amount of debt. However, you will often find that the amount you are approved for is lower than what it would have been without the debt. Many lenders take into account the 43% debt-to-income ratio. This consists of adding up the total amount of debt payments you make per month and then dividing that number by your gross monthly income.

If you qualify for a lower mortgage amount because of your debt, you can still achieve home ownership by purchasing something with a cheaper price tag. This could mean purchasing a house in the suburbs of the city or a fixer-upper that has potential. One advantage of purchasing a fixer-upper is that you can take your time customizing the house to fit your needs. You are also likely to make a bigger profit once the renovations are completed and the time comes to sell your house.

Apply for Non-Traditional Loans

Mortgage lenders make their own requirements for approving or denying an application. Just because you are denied by a specific mortgage company does not mean that you cannot get approved for another. Alternative non-traditional mortgage lenders include hard money lenders, credit unions, and through seller financing.

It might take a little extra research, but with the right loan, you can purchase the house of your dreams. If you do choose to go the non-traditional route, be sure to shop around for the best interest rates. It is also important to choose the right lender for your student loan debt. Taking out a private student loan can get you an affordable interest rate for your student loans and can give you the financial freedom to comfortably make your mortgage payments.

Your college degree does not have to hold you back from purchasing your first home. These tips will help you qualify for and afford the purchase of a house.