Baby Boomers, as defined by the 75 million Americans born between 1946 and 1964, are said to be “clogging up” the housing market. How? While, generally speaking, Americans are known to follow a rite of passage in life – get married, have kids, buy a house, move to a bigger house, and retire into a smaller home – Baby Boomers are bucking this trend.

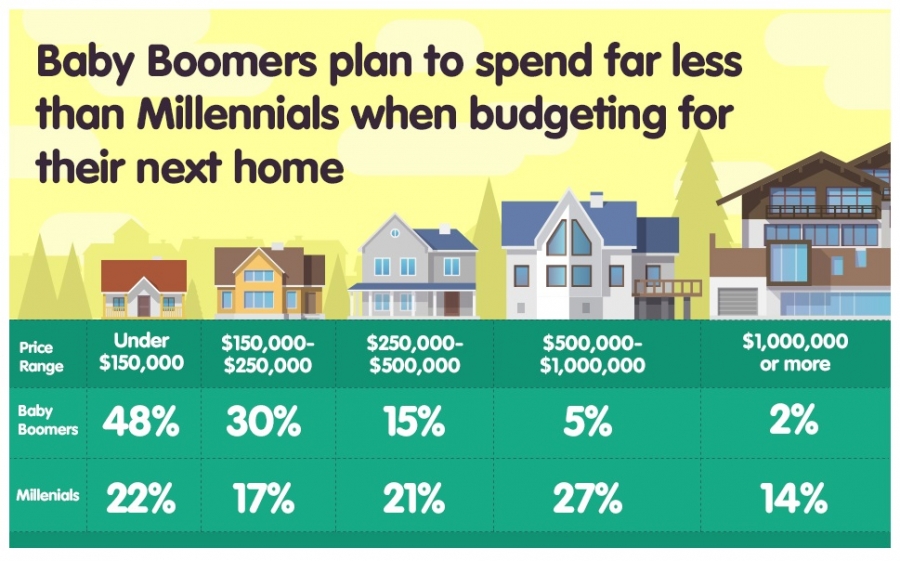

ValueInsured Modern Home-buyer Survey, conducted by Equation research

ValueInsured Modern Home-buyer Survey, conducted by Equation research

Proud to Be a Baby Boomer:

Baby Boomers are for the most part deciding to stay in the large homes where they raised their kids. While at first glance, this might seem like a sentimental decision, economic factors play a role as well. Boomers are healthier and working longer than previous generations, which means they aren’t yet ready to sell their homes. In fact, according to the Department of Labor, about 20% of Americans 65 and older are working or looking for jobs, up from 12.1% in 1996. Additionally, with the rising costs of smaller homes, many “Boomers” think it is unwise to sell a large home, especially if the large home is paid off or has substantial equity, for an expensive, smaller house.

On the other hand, Boomers who are interested in downsizing are running into another issue: millennials do not seem interested in buying their homes. As explained by Alejandro Trujillo, a 33-year-old Chicago real estate agent, even though Boomers tend to think that if a house has been good enough for them, it should be good enough for the next generation, that has not proven to be the case. In fact, the National Association of Senior Mover Managers indicates that some adaptations made by the Boomers may have to be undone when it is time to sell since there is a generational gap with what younger buyers want. Since the early 2000s, buyers increasingly have favored smaller houses with modern designs to large, elaborately detailed houses, and many prefer to live a walkable distance from retail stores rather than in remote locations. Further, as Boomers adapt their houses to accommodate them as they age, some lose sight of how the changes affect the market appeal of the property. This, in turn, means many Boomers end up selling their spacious homes for less than they paid to build them – again making Boomers think twice about even moving in the first place.

Impact on New Buyers:

The housing market is cyclical. Yet, with the ”near-gridlock” in the housing market, caused by Boomers staying in place, about 1.6 million homes have been kept out of buyers’ reach in recent years, sharply reducing the availability of housing nationwide.

It Is All In the Spokes

The Boomers are a “stick in the spokes of homeownership” which relies on older people exiting to free up houses that can be resold to first time buyers, keeping the market moving. While that may be the case, there are other reasons for the sluggish housing movement, including the tightening of foreign investment and the student loan crisis. Bottom line: Boomers and market factors, regardless of age, all play a role in the evolving real estate market.

From The Trenches,

Roy Oppenheim

Orignally posted on South Florida Law Blog: Baby Boomers: Gridlock In the Housing Market https://southfloridalawblog.com/baby-boomers-gridlock-in-the-housing-market/