|

Are There Tax Advantages of Buying a Home?

If you’re thinking about becoming a homeowner any time soon, there are tax benefits to buying. In particular, tax deductions are one way to reduce your tax bill and income. Tax deductions are different from credits. Credits are money that gets taken off a tax bill. You can think of them somewhat like a coupon. A tax deduction reduces your adjusted gross income or AGI, reducing your tax liability. If you’re thinking about becoming a homeowner any time soon, there are tax benefits to buying. In particular, tax deductions are one way to reduce your tax bill and income. Tax deductions are different from credits. Credits are money that gets taken off a tax bill. You can think of them somewhat like a coupon. A tax deduction reduces your adjusted gross income or AGI, reducing your tax liability.

The following are key tax benefits and things to know for homebuyers or possible homebuyers.

Mortgage Interest Deduction

Homeowners can deduct interest on their home mortgage for the first $750,000 of mortgage debt. That limit is $375,000 if

|

|

|

|

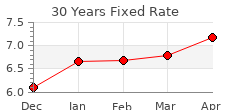

MORTGAGE RATES

U.S. averages as of April 2024:

30 yr. fixed: 6.79%

15 yr. fixed: 6.11%

5/1 yr. adj: 6.46%

|

|

|

|

|

you’re married and filing separately. If you bought your home prior to December 16, 2017, an old limit of $1 million applies, and $500,000 if you’re married but filing

|

|

|

|

Inspection vs. Appraisal: How Do They Compare?

When you’re buying a home, you’ll need two types of inspections—one is the actual inspection, and the other is the appraisal. They seem similar at first glance because both, as you might guess, involve a walkthrough of the property. They have different purposes, however. The information obtained is also reported to different parties. When you’re buying a home, you’ll need two types of inspections—one is the actual inspection, and the other is the appraisal. They seem similar at first glance because both, as you might guess, involve a walkthrough of the property. They have different purposes, however. The information obtained is also reported to different parties.

What is a Home Inspection?

An inspection is thorough and is done by a professional, qualified home inspector. The inspector will look at the safety elements of a home and the integrity of the structure.

The systems and structural elements an inspector looks at include the plumbing, electrical, and HVAC systems, roofing, and siding.

A home

|

|

|

|

What Are Cash Reserves and Why Do You Need Them?

When people talk about closing costs, it typically means the direct costs of getting a new mortgage. But there are two primary types of closing costs, often times referred to as recurring and non-recurring charges. Recurring charges include things that will happen again and again as one owns the home. What might they be? Recurring charges are things such as property insurance, interest and property taxes. Those will come due each and every year. When people talk about closing costs, it typically means the direct costs of getting a new mortgage. But there are two primary types of closing costs, often times referred to as recurring and non-recurring charges. Recurring charges include things that will happen again and again as one owns the home. What might they be? Recurring charges are things such as property insurance, interest and property taxes. Those will come due each and every year.

Non-recurring closing costs are one-time fees. The fees you’ll see on your settlement statement. These ‘one-offs’ are items such as a property appraisal fee, lender charges and other third party services such as attorney fees. These are one-time charges associated with your closing your loan.

These fees are all added together to arrive at a ‘cash to close’ amount. This of course means including your downpayment. When lenders ask for your bank or investment

|

|

|

|

|

How To Choose The Best Refi: It’s Not Just About The Rates

As mortgage rates continue their freefall, more and more homeowners are opting to refinance. With the recent dips, experts are saying that even those who refinanced in 2019 should take a look to see if they can save money. How much is it going to cost you? As mortgage rates continue their freefall, more and more homeowners are opting to refinance. With the recent dips, experts are saying that even those who refinanced in 2019 should take a look to see if they can save money. How much is it going to cost you?

Yes, refinancing to lower your rate and your payment is typically a good idea. But refinancing isn't free, and the fees you pay can add up. Make sure you take a good look at all of the fees, negotiate where you can, and figure out how long it's going to take you to break even.

“Estimate your break-even period: the time it takes for the accumulated monthly savings to exceed the loan fees,” said NerdWallet. “For example, if you pay $3,600 in fees to save $100 a month, it will take 36 months to break even ($3,600 divided by $100 equals 36). If you believe you’ll stay in the house beyond the break-even period, it might be worthwhile to refinance.”

Think about the terms

Who says you need to stick with a 30-year loan? With rates this low, it might be time to look at a 15-year term. Maybe you want to

Daily News and Advice

Daily News and Advice

Read about the events shaping the Real Estate market today, find current interest rates, or browse the extensive library of advice and how-to articles written by some of the top experts in Real Estate. Updated each weekday.

|

More Articles

|

|

|