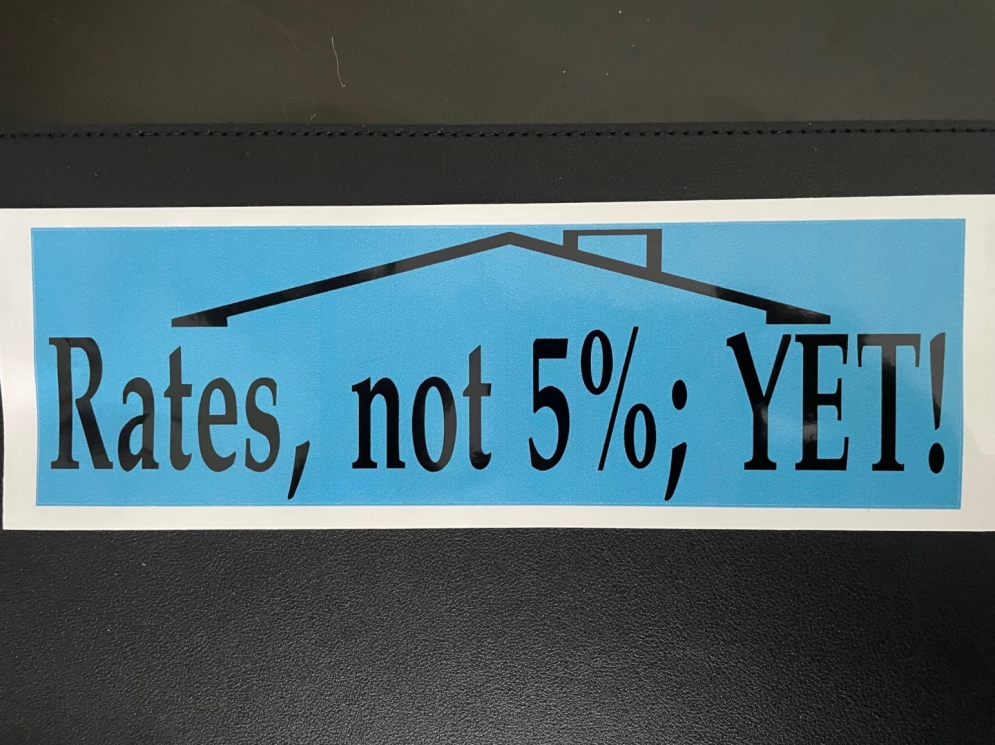

We have talked about rising interest rates quite a bit and how to share the actual information and how to do the math about the real costs of higher rates as well as the real costs of waiting! However, some people are having a tough time on how to go about bringing up the conversation quickly and easily so, I have added another bumper sticker to the toolbox!

Many of you already have and are using the “Got Mortgage” bumper sticker on your laptops. We have seen countless times how a simple message on your laptop can create opportunities; so here is the next addition to the family! All my current clients have already, or soon will receive, the new edition. Please feel free to use it proudly to convey a message, and possibly a warning! And not to worry, if rates continue to climb, I will be sending you “patches” in different colors you can use over the current sticker to show “6%” – “7%” – “8%” etc.

If you have team members who would like their own sticker, or if you need extras for other uses, please email me with your request and the address you would like me to send them too and we will accommodate you on a first come first served basis while supplies last!

Rising markets can create fear. Fear is only overcome by education and strategies to deal with the situation productively. You can feed into the fear and push into the panic; or you can educate yourself and others on how this presents a series of new opportunities.

Remember, some of your fellow originators and managers are having a real challenge generating loan opportunities as rates go higher. If they need help with coaching, training, or an accountability partner; please feel free to direct them to me and I will be happy to speak to them about how I might be able to help!

Now get out there and create some new opportunities!

Questions or comments: This email address is being protected from spambots. You need JavaScript enabled to view it.