Residential loans (Conventional and Government) are originated in the Primary Market and sold in the Secondary Market consisting of both public and private investors who buy mortgage notes. These investors are primarily Fannie Mae, Freddie Mac and Ginnie Mae. Lenders then replenish cash reserves so they can originate more loans. The Primary Market is important to the consumer because this is where it's created. These loans all end up in the same place and are offered by the same lenders, just through different channels. This makes selecting the originator the most important part of the mortgage process. With recent industry changes/trends and in protection of the consumer, we support competition and choice.

What does your position mean as a consumer entering the primary mortgage marketplace and why is it so important? That’s a good question that many don’t want you to know the answer to….

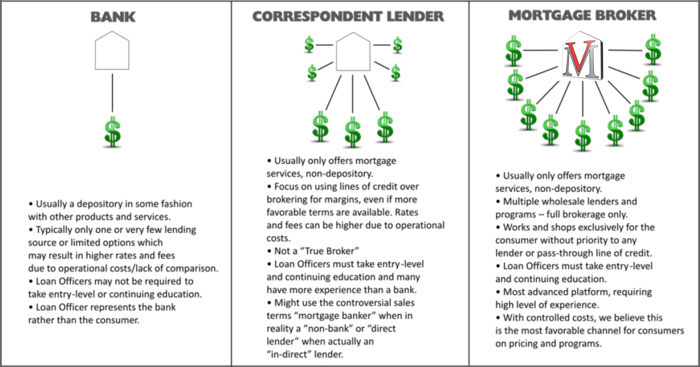

Consumers in the United States preparing to buy or refinance a home have access to the same agency-backed residential conventional and government loans (bought or insured by Fannie Mae, Freddie Mac, or Ginnie Mae) through different origination mortgage channels. These channels include retail banking or depository institutions, correspondent lending, and wholesale lending. Under retail and correspondent lending, the Mortgage Loan Originator (MLO) is employed by the lender. Under wholesale lending, the Mortgage Loan Originator (MLO) is employed exclusively by the brokerage working on behalf of the consumer (not by the lender) creating more independence. Wholesale lenders do not employ Mortgage Loan Originators and rely on the licensed local brokerage to bring their product to the consumer. Many believe this is the most cost-effective way for lenders to originate mortgage loans. While the agency guidelines and investors are identical as controlled in most cases by a computerized approval prior to lender selling the loan… the pricing, execution, and experience of staff will be greatly diverse. These channels are certainly not created equal and the pricing and execution the consumer will experience will rely on their position. Remember, the lender is just a pass-through to the agency/investors that buy, insure, or guarantee these loans. Consumers must be aware of sales people using false terms such as “direct lender” or “in-house” underwriting when inaccurately portraying an advantage, when many consider a disadvantage. Great service is expected by all in today’s world, but what the consumer doesn’t know on margin and overhead may significantly impact the terms of their mortgage liability.

As many can imagine, the regulatory environment has greatly changed in the mortgage and housing industry after the great recession of 2008. As a result, awareness and adaption on consumer impact must control the vision of a mortgage company now and in the future through collecting data and facts over all else. Vantage Mortgage Group (serving Oregon and Washington exclusively) has embraced these changes and rely on their clients positive experience and price advantage to produce more referrals. This requires that they align their clients in the bestposition they see possible which is as a true mortgage broker without credit line(s) influence. Because of this, Vantage persistently educates consumers and colleagues on understanding the indisputable math and data around mortgage operations rather than the hard sales pressure that many consumers and others receive in the primary mortgage marketplace. Operationally, Vantage believes that the wholesale origination channel with lender comparison is the only channel (if operated properly under current regulatory requirements) in which the consumer is not steered toward temporary lines of credit rather than lender comparison prior to loan sale. The company, however, greatly supports competition and all channels of loan origination if run properly for consumer choice.

Vantage offers a large variety of wholesale lenders for comparison on pricing, execution, and program guideline overlays. Vantage Mortgage Group’s origination fee is paid directly by the wholesale lender selected, all at the same margin, making comparison relevant and transparent under one pricing engine holding all preferred lender rate sheets. Vantage believes there is a significant advantage for their clients on pricing and execution when lenders compete for their business. They make rate and program option selection very clear by comparing several rates against lender rebates (credits) and optional buy-down costs. Consumers are only able to access the advantages this channel offers through a “true” mortgage brokerage such as Vantage (not those claiming to be both a “banker” and “broker” which can be deceiving as credit lines take away all advantages of being a broker). Vantage Mortgage Group again supports competition and choice under any channel for consumers, but offers this unique position for their clients that very few still do. They believe that their position, combined with their elite experience, produces a favorable outcome for clients which has been proven through their reputation and hundreds of testimonials.

Contact Vantage Mortgage Group today and experience what others are talking about!

NMLS # 35986. Equal Housing Lender.