Daily News And Advice

The Sweet Spot of Pricing Your Home

When you and your REALTOR® sit down to price your home, you'll be looking at competitive homes that are the most similar in size, location and amenities as your home. You may find that prices can be thousands of dollars higher or lower. It's tempting to pick the highest price and say, "Let's list it here." But what if your home doesn't sell at that price?

High prices are a strategy that can work in an accelerating market, but it's risky. Your home can sit for months without selling and you'll end up marking the price down, perhaps lower than it should have sold for in the first place.

Pricing your home is a science. The science is choosing the right price at which your home will sell quickly. How do you do that? By analyzing your local market conditions and where your home fits in the spectrum.

The only way your home will sell at the highest price possible is if your buyer agrees to your home's value. To best determine market value, you have three important tools: CMAs, appraisals, and your REALTOR's®knowledge of the market.

The comparative market analysis

A comparative market analysis (CMA) is a side-by-side comparison of similar homes for sale as well as homes that have recently sold in your neighborhood. REALTORS® use CMAs to compare the features that make each home unique, including age, location, number of bedrooms, baths, room sizes, updates, condition, etc.

As a seller, you should be able to see where your home fits -- in the top or lower price range of similar homes. For example, if a similar home to yours has been recently renovated with a new kitchen, expect it to sell for more than your home if your home has not been improved.

The appraisal

An appraisal is a market analysis performed by a professional appraiser using a variety of sources, including multiple listing system data and conforming loan formulas.

Appraisers most often work for lenders to determine market values, so that lenders can weigh the risk of making a loan to a homebuyer. Appraisals come after an offer is made when the buyer applies for a loan. Even though the buyer pays for the appraisal, the lender uses it to determine whether or not to make the loan at the contract price.

Other market data

Your REALTOR® has access to data that may not be public through the Multiple Listing Service. This data is provided to broker members to track market trends over weeks, months and years. Some brokers pay data companies for specific markets that help them plan their business, such as the number of listings on hand, which zip codes are the hottest, and whether closings are trending up or down over last month or last year.

Your REALTOR® uses all this data to help you hit the sweet spot of pricing. That's high enough to reflect your home's value, but attractive enough to buyers to get it sold quickly.

FULL STORY->

|

There Are Conditions, And Then There Are Conditions:

In all my years in the mortgage industry, and there are a lot of them, I don’t recall a single loan application I submitted to underwriting that didn’t come back with approval ‘conditions.’ What exactly does the term mean? Essentially, it means the loan may be approved based upon certain conditions. All loans have them, perhaps a few skate through but those are extremely rare. But there are two types of conditions, and one is more important than the other, although they all have to be met.

Today, loan applications are submitted through an automated underwriting system. Where it used to take an hour or two to physically have an underwriter review and approve a loan application, the system accepts then spits out the result. And if the loan officer and processor has properly documented the file, the results will be presented. Now for the condition part.

The easy conditions are the ones that are pretty basic and primarily make sure the loan file is updated. For example, credit documents within a file must be within 30 days old. Paycheck stubs for instance, must fall within this 30 day window. So too are bank statements and others. These are pretty simple and many times these conditions can simply be brought to the settlement table or otherwise provided directly to the lender for review. These are referred to in the industry as ‘prior to funding’ and must be reviewed and approved before the lender will release the funds needed for the loan.

The other type of conditions, sometimes referred to as ‘prior to doc’ conditions, must be reviewed prior to the loan going any further into the approval process. This type of condition states that whatever is being asked for is presented and reviewed before loan documents can be produced. Whereas prior to funding conditions can be settled at the closing, prior to doc means you won’t get near that milestone without these. What are some prior to doc conditions?

One might be for the borrower to explain a drop in income from one period to the next. Did the applicant get temporarily laid off? Is he/she still employed? Was there an illness in the family that created a temporary employment pause? With these types of conditions, the lender just wants to make sure everything is good to go before going much further.

One final word, don’t freak out when the lender comes back with questions. There’s little chance of the loan approval being in jeopardy, it’s mainly to keep the loan file in compliance with approval guidelines.

FULL STORY->

|

5 Surprising Ways to Invest in Your House

For many people, a home is their largest and most important investment. The good news for people around the country is that housing markets continue to appreciate. After the housing crisis several years ago, home values have increased every year.

With additional equity in their homes, many people are starting to think about investing money back into their home. There are numerous ways that you can improve the value of your home.

Expanded Driveway

One area that many people never think about changing is their driveway. Over the years, a lot of people have learned that they can expand their driveway to hold more cars. This is especially useful if you have multiple vehicles that members of your family drive.

In the average neighborhood, there is simply not enough space for more than a few cars. It is a small investment to expand the driveway of your home, and the potential future buyers will love this feature.

New Cabinets

The kitchen is one of the most important areas of the home when it comes to selling. Cabinets are a central point of any kitchen. If you want to improve or replace your cabinets, it is vital to work with a company that has experience in the field. Look for cabinet refinishing companies near you through online sources.

The cabinets in your kitchen should flow with the rest of your home. With such a large investment of both time and money, make sure that you have conducted research on the best cabinets for your current home.

Tile in Bathroom

Another vital room in your home is the master bathroom. You will spend a lot of your time in this room, so it is important to make it as inviting as possible.

Upgrading the floors in your bathroom is a great choice. Tile is the most common piece of material to use. Not only does it last longer, but it looks much better than other options as well.

Heated tile is another feature that many people enjoy. In the cold mornings of the winter, heated tile can be a nice luxury. As soon as you walk on the tile, your feet will be heated and you will enjoy the bathroom experience much more. This is new technology that a lot of people are upgrading to.

Smart HVAC System

Everyone knows that a new HVAC system is not cheap. However, there are new HVAC systems that focus on reducing your total energy consumption. Although these units are still expensive, you will save some money every month on lower electricity bills.

With so many options on the market today, it is vital to spend some time finding the right model for your home. If you live in a cold area, make sure the heating unit is large enough to heat your entire home. In many areas, the upstairs part of the home is difficult to heat in the winter without a large unit.

New Paint

Perhaps the easiest way to improve the value of your home is to simply paint the walls. New paint on the walls can really improve the look and feel of your home. Although you can do the painting yourself, it makes sense to hire someone who has experience painting.

Painting an entire house is a long process. Although it will not be cheap, it will improve the value of your home greatly. This is one of the best things to do right before you list a home on the market.

Investing in your home is one of the best financial decisions that you can make. As the housing market continues to improve in value, investing in your home will help you financially. You can even use the equity in your home to pay for the new upgrades that you want.

FULL STORY->

|

Is an ADU for You?

Whether you call them granny flats, in-law units, tiny homes, or carriage houses, accessory dwelling units (ADU) aren’t going anywhere. Except, possibly, in your (or your child’s) backyard.

Is an ADU the answer to the dilemma of where you’re going to live during your retirement years? Or where to move your parent who wants his or her own space close to you? That’s the idea that’s intriguing many across the country.

So, what do you need to know about ADUs? We’re breaking it all down below.

Are they easy to build?

You would think so, given their small size and the fact that, presumably, they are being built on land you already own. States like California have passed laws to make them easier to build, resulting in tremendous growth. "At the start of 2017, a California state law went into effect that forced cities to relax their regulations on basement suites, garage apartments, and backyard cottages—known collectively as accessory dwelling units (ADUs),” said Sightline Institute. “Two years later, building permits for ADUs in Los Angeles have surged by a factor of 30—yes, 30!—comprising a whopping one fifth of permits issued for all homes.”

However, not every state or municipality is quite so progressive. “Barriers to the growth of granny flats include municipal statutes, zoning laws, building restrictions, neighborhood covenants, and other regulations,” said The Spruce. “New construction is more expensive as well, and homeowners may find it difficult to get financing. Connecting utilities can also be expensive. Some municipalities require that driveways and/or off-street parking be provided for the granny flat occupant, and that can add expense, or be completely unfeasible for certain properties.”

Cost

Speaking of cost, part of the allure of an ADU is how affordable it is in comparison to a typical single-family residence. But it’s still in investment. “A legal accessory dwelling unit which includes a kitchen and bathroom, costs typically start at $80,000 and quickly move up from there,” said Maxable. “For a stand-alone accessory dwelling unit expect the cost to start at $150,000 and increase from there.”

The cost of construction isn’t all there is, however. “Homeowners are often shocked at the cost of permitting, which is why there are so many illegal accessory dwelling units out there. In some cities, where development and impact fees for this type of construction has not been waived, homeowners can expect to pay upwards of 20K in fees.”

That includes impact fees, which cities charge homebuilders to assist in paying for things like schools, parks, and roads. “In Washington, for example, depending on what city you live in, so-called impact fees alone might total as much as $9,000,” said Sightline Institute.

Another word on regulations

Regardless of the legality in certain areas, there are those other restrictions that may make it challenging to build an ADU on a specific property. Specifically, zoning restrictions can limit what you can do with your ADU, where you build it, and even who can live inside.

“Many cities and counties permit ADUs in one or more single-family zoning districts by right, subject to use-specific standards,” said the American Planning Association (APA). “Common provisions include an owner-occupancy requirement (for one of the two dwellings), dimensional and design standards to ensure neighborhood compatibility, and off-street parking requirements. Other relatively common provisions include minimum lot sizes and limits on the number of occupants or bedrooms. While some codes also include occupancy restrictions that stipulate that ADUs can only house family members or domestic employees, this type of restriction can severely limit the potential for ADUs to address a shortage of rental housing.”

Before you move ahead with plans for an ADU on your property, check with your state and local authorities. “In some states, localities must permit ADUs by right, under certain conditions. In some others, state laws preempt some aspects of local zoning for ADUs or actively encourage cities and counties to adopt permissive zoning regulations for ADUs.”

FULL STORY->

|

|

|

|

|

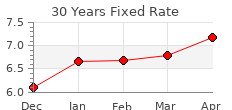

Mortgage Rates

Averages as of April 2024:

30 yr. fixed: 6.79%

15 yr. fixed: 6.11%

5/1 yr. adj: 6.46%

|

|

|

|