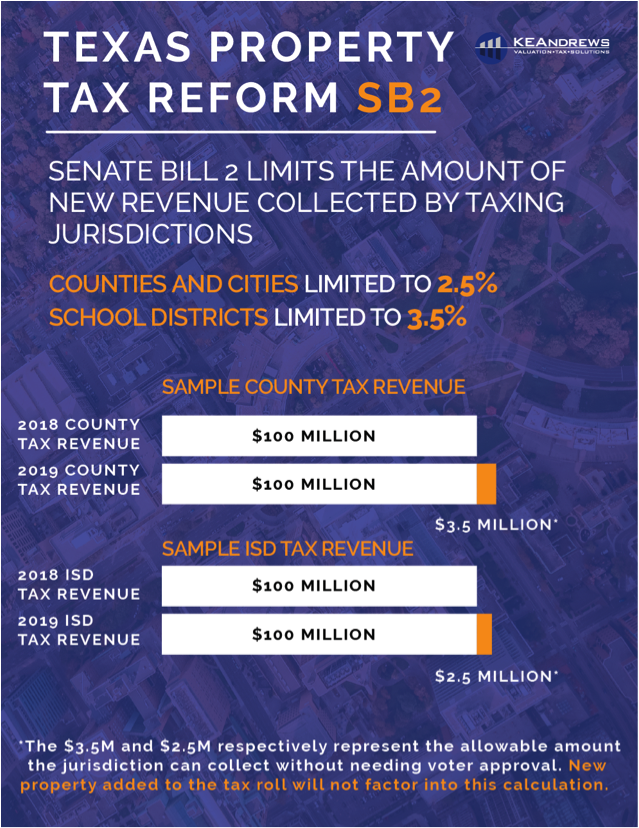

Republican Gov. Greg Abbott signed HB 3 and SB 2 on Wednesday, stating that the two bills would take a significant step towards curbing the rise of property taxes in the state. SB2 will set a cap for cities and counties for new tax revenue received at 3.5% annually and sets a cap for school districts at 2.5% beginning in fiscal year 2021. If a jurisdiction decides to receive more revenue than the cap set forth, they will require voter approval. Historically, that cap has been set at 8% but didn’t automatically trigger a vote for approval on the revenue increase. Under the new bill, if a cap is exceeded, a vote will be automatically triggered.

“This is a session that has addressed and solved challenges that have plagued our state for decades,” Abbott said. Property tax has been what Governor Abbott considered his “top priority” since 2017.

Lt. Governor Dan Patrick has been a long-time proponent of property tax reform and he said that the measure would prevent an appraised value from being used against property taxes. Mr. Patrick expanded on the new bill saying that without legislation, it “was a train wreck coming, and we put a stop to the train wreck this session”.

Lawmakers have urged local cities and jurisdictions to not create any new fees or revenue sources, promising to shut down any new measure in the next legislative session.

What has been the problem?

The leaders have spent the last few years discussing how to slow the growth of rising property taxes in the state. There have been numerous proposals on the cap and how to offset the funding lost from the implementation, from a 4% or 5% cap and even the suggestion of adding one cent to the state sales tax. Here are the two main changes in SB2 we are seeing in effectively what has become the Texas property tax bill.

• 3.5% revenue cap on local governments. This means cities and counties can collect only up to 3.5% more in property tax revenue than they did the previous year.

• 2.5% revenue cap on schools. Schools districts are included under the cap, but at a lower percentage.

SB 2 will only take into account the current total value of property within the jurisdiction lines. For the following year, the total tax revenue will be totaled and then the new property additions will be added to the tax rolls, setting a new baseline going forward.

What will the bill look like in action?

As a rough guideline in the state of Texas, a school district makes up 40-60% of the total property tax rate, with the city and county making up 10-25% and the rest being filled with special jurisdictions or colleges. If a county collected $100,000,000 in tax revenue last year, it will be allowed to only collect an additional $3,500,000 for 2019. For the school district portion, that number would fall to $2,500,000 or 2.5%.

Over time, Texans will see if SB 2 lives up to its billing to curb property values and help offer the relief so many property owners have been seeking.