31 percent of properties in the UK have had to reduce their initial asking price before being sold, according to a recent study. Of the top 20 towns and cities where house price reductions are the greatest, 17 are situated in North England and Scotland, whereas only three are in South England. London didn't quite make the top 20, but still experienced house price cuts on 30 percent of homes before securing a sale over the last decade. Stockton on Tees is at the top of the list, with 49 percent of properties seeing cuts, followed by the third largest city in Scotland, Aberdeen, at 46 percent.

A UK property buyer can currently expect an approximate £25,000 discount when buying across the nation, according to Zoopla; with an even greater discount of £57,323 for London property seekers.

Mayfair's premier real estate agent Wetherell researched the matter and discovered that the number of sales in the neighbourhood in 2017 so far has been overtaken by the number of homes withdrawn from the market. The 30 retracted properties are valued at a substantial £114 million, compared to the 26 sales totalling an approximate £83 million.

What is causing the miscalculations?

The growing number of mispriced additions to the UK property market and ensuing withdrawals would typically be blamed on the inventory far outweighing the demand. However, the upcoming Brexit and political chaos cloaking the nation has led to economic uncertainty, and new additions to the market have been declining over the last 12 months, where demand is relatively high.

Lack of knowledge of the local area is reason enough for some agents to price a property incorrectly. For others, it's simply a matter of securing a client, and therefore high sales prices are being promised to sellers when the agent knows that the price will need to be reduced before a buyer can be secured. This attitude towards property valuations has grown in line with the rising use of multi-agency instructions and the presence of online real estate agents and property search websites.

Back when the internet had a mere 10 million users, property buyers would select an estate agent and work with just that one company. The agent would price, market, and sell the home for the vendor without any involvement from another company. Vendors would choose their agent based on the fact that they were highly experienced in their field, their local market, and buying and selling trends in the area. This practice would ensure that properties would be priced correctly and sold at that price, or as close as.

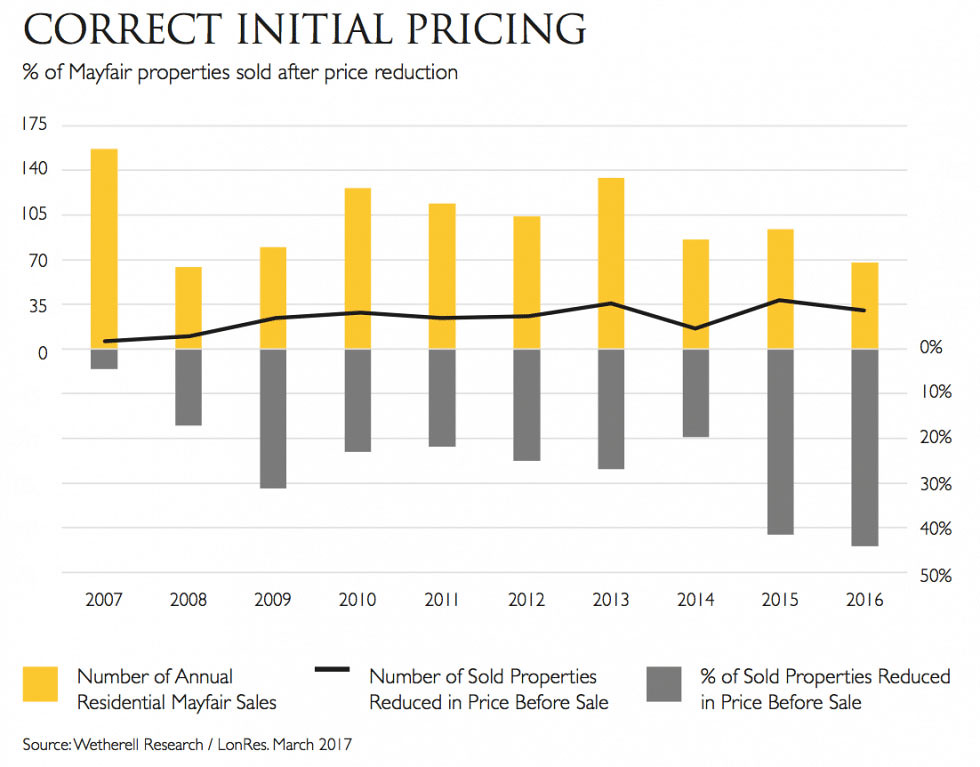

As multiple agency usage has accelerated over the last decade, where it is not surprising in this instance to have one agent price the property, and another sell it, so have incorrectly priced properties entering the market. The expanding real estate industry online has also led to unfamiliar agents and lack of local knowledge to play a part in this poor practice. These changes are apparent in Mayfair when reviewing the sales figures for 2016. During last year, 45 percent of property sales had multiple agencies involved in the process, and exactly 45 percent were incorrectly priced upon first entering the market and had to be reduced before a sale was made.

Peter Wetherell, CEO of Wetherell, said “Mispricing is deeply unhealthy and extremely bad for the good reputation of estate agency professionals who are experts in their local marketplaces.”

Overpriced properties can take more than double the time to sell

Data analysed from LonRes sales, and local market intelligence shows 1,047 residential sales in the neighbourhood since 2007 up to the end of last year, of which 245 were incorrectly valued and reduced in price before selling. Trends also revealed that a correctly priced residence would typically sell in a three to six month period, where a higher price can take over double that at 14 months and in the rare instance of an undervalued property, it will only take one to two weeks.

The property landscape in Mayfair, as of March this year, shows 160 properties for sale, of which the average time on the market is ten months. These figures indicate that 70 percent of the 160 are priced incorrectly, totalling around £1.1 billion based on an average £4.6 million per unit. Five percent are thought to be underpriced, leaving only 25 percent of the 160 with the correct prices. These miscalculations have caused price reductions and slowed sales, affecting trust among buyers and sellers alike.

Robert Windsor, Development & Sales Director at Wetherell, says "It speaks volumes to us that 80% of the sales in Mayfair over 2015 and 2016 were handled by just two estate agents – Wetherell as the leading specialist boutique agent for Mayfair plus a leading corporate agent. Our local offices have highly experienced senior teams and a deep knowledge of the Mayfair marketplace. When Wetherell is instructed on a sole agency basis, or with another on a joint agency, the property is consistently priced correctly, marketed professionally and sold successfully.”

“However, so many times over the last five years, we have taken on properties which have previously been instructed with other agents or multiple agencies who have a far less knowledge of Mayfair or have slipped into a valuation “price war” in order to please the vendor and win the instruction, and the result has been mispricing and no sale. Eventually, these instructions have come back to Wetherell to resolve. It is interesting to see reports from portals of increasing price reductions – this does not mean that values have come down; merely that the properties have eventually reached their correct marketing price and are in line with local comparables.”

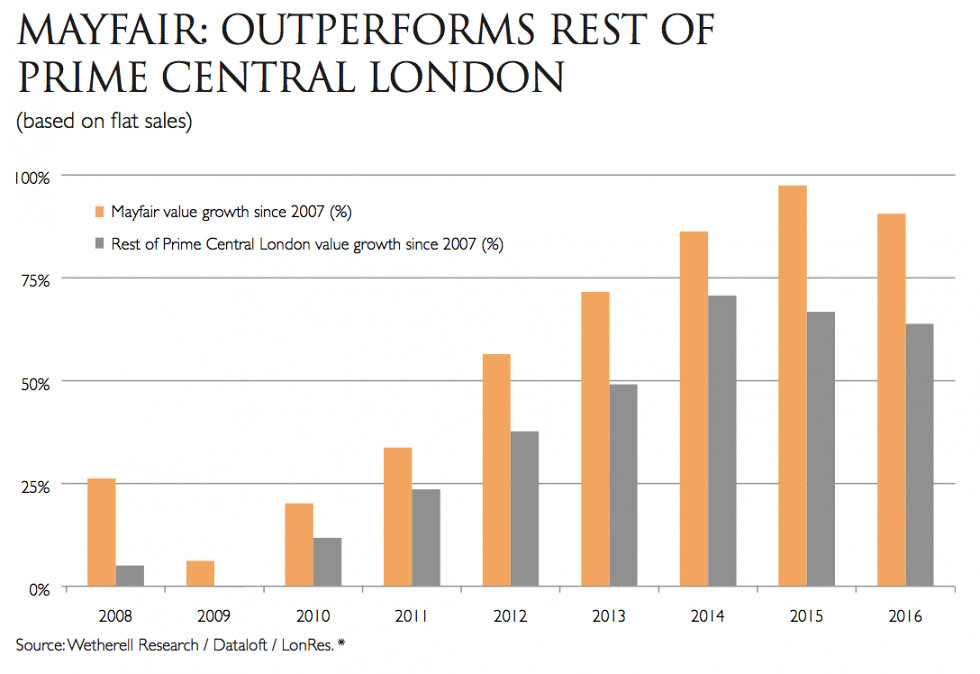

Despite the mispricing across London and the rest of Britain, Mayfair has successfully sold 90 percent of their market over the past decade, where wider Prime Central London has only achieved 70 percent. Mayfair is predicted to continue performing at these levels, with the introduction of several new residential developments in the next five years - which will also help to cement Mayfair as number one residential spot in London, which was reclaimed earlier this year from Knightsbridge.