|

What Sellers Should Know About Pets and Showings

Buyers and their agents need to feel welcome to look at the property at their leisure without danger or distractions. So while you adore your sweet-tempered pit bull rescue, he could turn territorial, barking and growling at potential homebuyers. And it could cost you the opportunity to sell your home. Buyers and their agents need to feel welcome to look at the property at their leisure without danger or distractions. So while you adore your sweet-tempered pit bull rescue, he could turn territorial, barking and growling at potential homebuyers. And it could cost you the opportunity to sell your home.

Think of buyers as guests and work to make them feel comfortable as they consider your home for purchase. If you have a protective dog or one that isn't well-trained, drop her off at doggie day care when you know your home is going to be shown. Or call a pet sitter on call who can take your pet for a long walk while your home is being shown.

If you

|

|

|

|

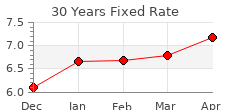

MORTGAGE RATES

U.S. averages as of May 2024:

30 yr. fixed: 7.17%

15 yr. fixed: 6.44%

5/1 yr. adj: 6.68%

|

|

|

|

|

you must leave the dog at home, don't expect real estate professionals to handle your dog. They are not dog trainers and should not be expected to risk a dog bite to show your home to buyers. This

|

|

|

|

Putting Zeal In Your Curb Appeal

Curb appeal, the first impression your home conveys to prospective buyers, should create an emotional desire to own the home and enjoy the lifestyle and status it represents. Curb appeal, the first impression your home conveys to prospective buyers, should create an emotional desire to own the home and enjoy the lifestyle and status it represents.

Putting the best face on your home also should give a lasting impression that motivates buyers to cross the threshold and take that first step toward closing the deal.

Experts advise, more like a home improvement or exterior staging job than a cosmetic makeover, curb appeal that sings is particularly crucial now that more and more buyers are calling the shots.

Give your house model home level curb appeal for that "new" look and feel and buyers will beat a path to your door. That's because there's nothing like

|

|

|

|

What Does ‘Prior to Fund’ Mean

In general, ‘prior to fund’ means your loan approval is almost at the goal post. When lenders issue an initial decision, there will still be things needed to complete even though you’ve submitted everything your lender asked for. There are stages in the loan approval process and even though you probably realize it, lenders have given these stages different names. In general, ‘prior to fund’ means your loan approval is almost at the goal post. When lenders issue an initial decision, there will still be things needed to complete even though you’ve submitted everything your lender asked for. There are stages in the loan approval process and even though you probably realize it, lenders have given these stages different names.

When you receive your initial approval, there will still be some items needed. Usually these items are simply nothing more than getting your loan file in compliance. There are items in your file referred to as credit documents, things such as your paycheck stubs and W2s. These need to be within a 30 day window and many times if your loan application goes beyond 30 days, you’ll be asked to update a few things. This is common, especially so when a loan is submitted for a preapproval before a property is even located. You submit your documentation and begin shopping for a home. In all

|

|

|

|

|

FOR IMMEDIATE RELEASE

There were 206,049 visitors to Maui in March 2024, down significantly compared to 276,485 visitors (-25.5%) in March 2023 and 271,934 visitors (-24.2%) in March 2019. Visitor spending was $469.4 million in March 2024, compared to $619.9 million (-24.3%) in March 2023 and $443.3 million (+5.9%) in March 2019. The average daily census on Maui was 53,708 visitors in March 2024, compared to 70,111 visitors (-23.4%) in March 2023 and 69,349 visitors (-22.6%) in March 2019…

Continued >>>

Daily News and Advice

Daily News and Advice

Read about the events shaping the Real Estate market today, find current interest rates, or browse the extensive library of advice and how-to articles written by some of the top experts in Real Estate. Updated each weekday.

|

More Articles

|

|

|