Down payment assistance programs are very helpful to first time home buyers who do not have money to put down. But, sadly, a lot of people, especially the first-time buyers have no idea about how the down payment assistance program works. And because of this, they sometimes even have to bid farewell to owning their dream home. .

And the cherry on top is that there is not much help or guidance available over the internet for people to understand and exploit this option. There are some lenders that are not interested in providing information because of the paperwork involved in getting it done. Some real estate agents do not take the time to read up on what down payment assistance in their area. As a real estate agent, I suggest that your local realtors should take the time to understand each and every program that’s available in their city, county and state.

But, don’t worry, once you read my guide to down payment assistance, you will get a better understanding of what to do and look for. The below-mentioned factors will help you figure out if you are qualified for down payment assistance or not.

Income

For obvious reasons, there is a specific income limit that will make you eligible to apply for down payment assistance. Generally, these programs are designed for people with moderate to lesser incomes. Different assistance programs use different factors for specifying the income limit that includes the AMI, the size of your household, your income vs. your whole family income, etc.

Generally, the income limit ranges between 80 and 140% of the AMI for all the programs. On the other hand, the number of family members and family income varies greatly as per the program and region.

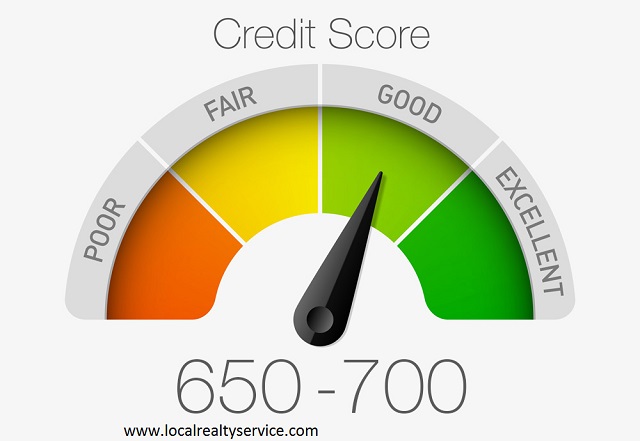

Credit Score

There is not much or at least any striking variation in credit score requirement of different programs. Most of these programs require you to have a minimum credit score of 640. However, there is always room for exceptions, so be prepared for that as well.

DTI Percentage

For those of you who don’t know, DTI stands for debt to income ratio. This measures how much of your earning is spent on paying off your loans. It helps in determining if you are capable enough to pay off your debt or not.

Just like income, there are particular requirements about DTI ratio as well, depending upon the program. The DTI for various assistance programs can range from 40% to 50%.

Type of Home

The majority of the assistance programs let you buy single family habitats or condominiums. However, if your need calls for a bigger place with double or triple units, then some of the programs even cater that. But, obviously, they have some additional requirements which you’ll need to fulfill.

Geographical Area

Not too long ago, the geographical location used to be a major deciding factor in determining your eligibility for the DPA. But now, the majority of these programs have eased up a lot on these geographical limitations. However, these restrictions aren’t completely eliminated from all the programs.

Therefore, some of them may require you to buy the home in a certain geographical location. That specific area can be a place with a higher number of minorities, a place having people with lower incomes, country side or any certain county limit. You may even be required to shift your job to a specific city or area for qualifying.