Financial Education: What Are Real Estate Investment Trusts?

By Richard Cox

Many investors will often come across the popular acronym which are not fully explained in the typical financial media news story. The term Real Estate Investment Trust (or REIT) was established by the U.S. Congress in 1960 as an active amendment in legislation for the Cigar Excise Tax Extension Act.

This important law provision is important for investors because it allows individuals to purchase exposure in portfolios devoted commercial real estate endeavors. The main advantage of this strategy is that it allows investors to receive income from a diverse set of properties.

How Exactly Does a REIT Work?

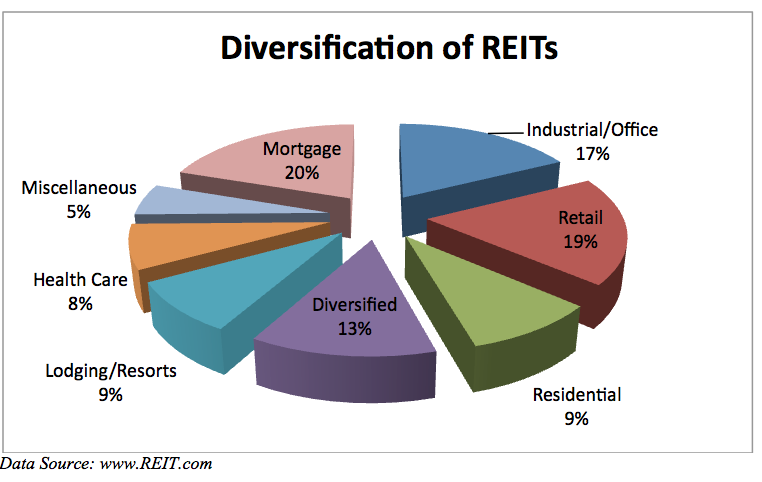

If we look at the general characteristics of a REIT investment portfolio , the properties selected for inclusion might include healthcare facilities, data centers, apartment complexes, retail centers, warehouses, self-storage, office buildings, and hotels.

In cases where REITs are devoted to public infrastructure, the real estate in question will typically involve properties dealing with energy pipelines, timberland, cell towers, fiber cables, or certain utilities structures. Most REITs have a variety of pros and cons which depend on the specialized real estate sector associated with the investment.

Those focusing on specific industries will be influenced by the financial and economic factors which are most commonly associated with that particular segment of the real estate market. That said, specialty REITs can often be highly diversified and hold different types of assets in their property portfolios.

In general, REITs will be associated with a relatively straightforward approach to the business: The REIT company will lease its spaces and ensure proper collection of the required rents on each property. Then, the company distributes the resulting income to shareholders in the form of dividends.

REITs will also have certain qualification requirements, and companies must comply with provisions which are outlined by the Internal Revenue Services Code. Stated requirements might include factors like primary ownership of income-generating rental properties, which is established over a long-term time horizon with income distributions to its shareholders.

Company Requirements

For investors, it is important to understand the specific requirements a company must achieve:

- Minimum total asset investment of 75% in real estate, U.S. Treasurys, or cash

- Minimum of 75% of gross income must be generated by real estate sales, financing interest from mortgages on real property, or from property rents.

- Each year, a minimum of 90% of taxable income must be returned to shareholders in the form of dividends

- After the first year of its existence, the REIT company must have a of qualified 100 shareholders

- Maximum of 50% of its shares may be held by five (or less) investors in the second half of any taxable year

Investment: Types of REITs Available

REIT enterprises can also have other requirements which ensure that each entity is IRS taxable as a corporation. In addition to this, the company must be managed by a trustees or a board of directors. To further complicate matters, there are also several types of REITs that are available. Each fund may have a classification which indicates the type of service that is offered by the business. REITs can also be classified in ways to that relate to the process by which fund shares are bought and sold in the market.

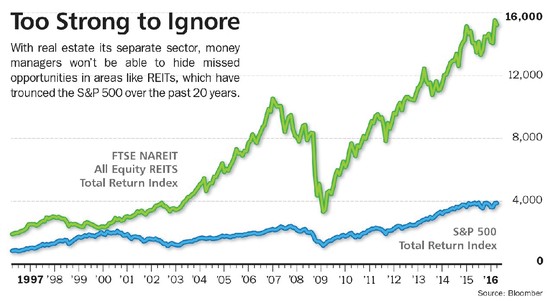

The most typical enterprise format is the Equity REIT which is a company that will purchase, own, and provide management services for income-producing properties. Revenue figures will primarily come as a result of rental payments (rather than reselling the portfolio properties).

Conversely, Mortgage REITs (or mREITs) will lend funds to owner/operators of real estate. That lending process may be conducted in direct mortgages/loans or in an indirect manner (through mortgage-backed securities acquisitions).

Mortgage-backed securities are holding pool mortgage investments which are issued by government-sponsored enterprises. Earnings figures will primarily stem from net interest margins margins, which are derived from the spread between the earned interest from mortgage loans and the cost involved when funding the loans). These securities are particularly sensitive to increases in interest rates because of the mortgage-centric focus which characterizes this form of Real Estate Investment Trust.