Women in Real Estate

Children categories

Here we are in October and as always, we must take some time and make our final coarse corrections to navigate the end of the year. The things we must be fully aware of are: • When is the last day I can accept a new loan application that will close in 2020?• Refinances are also dealing with the likely fifty basis point hit to agency loans on December 1st if nothing changes.• Who are the referral partners that are meeting or falling below expectations?• What are my personal projections for the remainder of the year?• Are there any targets in units, dollar volume, or activity that we can make a stretch for?• Holiday Calendar• Who are the five new referral partners I want to add to my network as part of the 2021 referral group?• Where am I on the 20 extra refinances?• Get your CE done NOW if you…

A few conversations this week brings today’s post. In a few completely different conversations with originators from different parts of the country, a parallel appeared and it was important enough for me to share. In two of these conversations, prospective new applicants came to the table with “Pre-approvals” from lenders they had talked with. They were asked questions and quickly given letters. In both cases the agent they were working with didn’t trust the letters and asked them to speak to my clients. In both cases, these people were not qualified for anywhere near the loan size they were “approved” for, and one of those didn’t meet the program guidelines for the program at all. In a different case than above, a new client came into the process of being pre-approved thinking her good credit automatically qualified her for any size mortgage she wanted. While it was true that both…

In less than a week since last week’s blog post, Karl Weiss in Arizona has put together 8 refinances, 1 purchase loan, two listing appointment referrals for his realtor referral partners, one of those appointments turned into a listing that is now under contract in less than three days, and a purchase loan application as soon as the sellers find their “Forever Home!” I asked you to spend just a few hours a week working the “Forever Home Strategy®” to secure 20 refinances, a few listing appointments for your realtor referral partners, and a couple of purchase deals. Karl took up the challenge and is well on his way to smashing all expectations! Great Job Karl! The commitment to following the plan and providing the best possible client information and experience, while becoming a trusted professional in your market is a special one, and one that absolutely is worth the…

September is here and so begins the countdown to 2021. Many people will be happy to see 2020 go, but for most of us in the mortgage business, 2020 has been rewarding and in many cases, EPIC! While having one of my coaching calls, I was speaking with a client about looking at the possible year end numbers and trying to set targets for the next 90 days, and one of the things he could agree too was committing a couple of hours in the middle of the week to connect with his database using the “Forever Home Strategy®” to generate an additional 20 “extra” refinance opportunities and within that effort, locate a minimum of three new listing & sale opportunities for his realtor referral partners. Given his market and commission structure, the net income for these twenty transactions would generate an additional $50K in income that he was going to use for a…

A bit about Summer: Summer Goralik is a Real Estate Compliance Consultant and licensed California Real Estate Broker (#02022805). Summer offers real estate brokers a variety of consulting services including assistance with California Department of Real Estate (DRE) audit preparation, mock audits, advertising review, and training. She helps licensees evaluate their regulatory compliance and correct any non-compliant activities. Summer has an extensive background in real estate which includes private sector, regulatory and law enforcement experience. Most recently, she worked for the Orange County District Attorney's Office as a Civilian Economic Crimes Investigator in their Real Estate Fraud Unit. Prior to that, Summer worked for the DRE for six years as an Investigator. Among many achievements, she wrote several articles for DRE, four of which were co-authored with former Commissioner Wayne Bell. Before she embarked on her career in government and law enforcement, Summer also worked in the escrow industry for nearly…

We spoke last week about the “90 day countdown” to get all the deals into your system so they can close in 2020. All very important points and I hope you take that information and use it to the benefit of your clients and referral partners. This week we need to add to that post an additional piece of very important information. Information we don’t always, if ever, get a heads up about. Interest rates on refinances WILL be going up in December. Make no mistake about it, the recent “tax” on refinances by the agencies has only been deferred to December, not eliminated! This is a very important distinction! Now more than ever it’s important to understand this important timeline and work within BOTH timeframes and coach your clients and referral partners about it. We know for a fact that there will be a fifty basis point increase in the cost of refinancing…

A bit about Cyndi: Cyndi Garza is a leader, owner of multiple businesses, speaker, trainer, and executive coach. Cyndi’s coaching career began when she joined a national mortgage firm to build a sales team in Michigan, which at the time was non-existent. She strategically recruited and trained a sales force of over 130 people, which — through her coaching — became the highest grossing team nationally for seven straight years by averaging just under a billion dollars in sales each fiscal year. Since 2001, Cyndi has held leadership positions where she has had the opportunity to identify strengths within her team, and develop those strengths to push people to grow and achieve more than they had imagined possible for themselves. Cyndi is the founder of Optimized Success — a coaching and training company with a focus on helping women find success in business ownership and leadership. Her personal motto is “You…

A bit about Tami: EXIT Realty Corp International’s CEO TAMI BONNELL is an internationally renowned leader in the real estate industry and was instrumental in building three major brands. Among her many achievements, she was recognized by Real Estate trend watcher, Stephan Swanepoel, three years consecutively as one of the 200 most Powerful and influential people in residential real estate, among the top 20 corporate executives and among the top 10 women leaders. Ms. Bonnell has been a featured speaker at the NATIONAL ASSOCIATION OF REALTOR’S® convention to the Top 500 power brokers, The National Women’s Council REALTORS®, Inman News Connect Conference and the RIS Media’s Leadership Conference. She was named to the National Association of Women in Housing & Real Estate Ecosystem ( NAWRB) Diversity & Inclusion Leadership Council (NDLIC). Ms. Bonnell was honored by STEM connector as one of it’s 100 Corporate Women Leaders in STEM (science,…

I have clients reporting back that they are having REALTOR®s calling them out of the blue, asking if they will take their referrals. Yes, REALTOR®s are calling mortgage professionals asking if they will take and close their deals is happening on a regular basis. This is not an unusual phenomenon, many of my clients have this happen occasionally by a REALTOR® who is unhappy with their current options, but it is happening more and more consistently and more frequently for sure! It is interesting to see the reasons these agents are giving for calling: • I have heard good things about you from a coworker and wanted to try you and see how it went.• I have seen you before but didn’t have an opportunity to send you.• I have had a series of bad transactional experiences with my current referral choice.• My current choice can’t get loans closed in…

More...

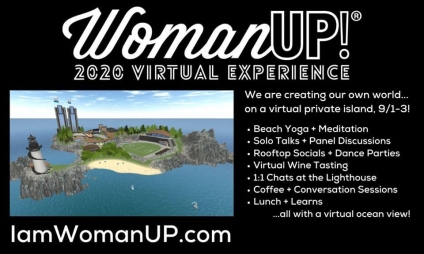

Lead by real estate moguls Leslie Appleton-Young, Sara Sutachan and Debra Trappen, WomanUP!® exists to support the journey of women to the very top of their careers. Their three-part mission is to "identify, develop, and connect women in this industry. We identify the tools and strategies you need to make bold moves in real estate. We provide you with resources and events to develop your skills as a leader. We create opportunities to connect with other amazing leaders in the national brokerage community." Terri Murphy sits down with the three powerhouse leaders of WomanUP! to discuss their upcoming event, the 2020 WomanUP! Virutal Experience taking place on September 1st-3rd. The event promises "the signature solo talks, group conversations, and social gatherings you have enjoyed since 2017 - and translating them to a unique virtual experience." Watch the full interview below: REGISTRATION IS NOW OPEN! Click here to visit the WomanUP!® website and to register for the 3-day virtual…

Our industry has always leaned harder on quantity than quality. It has only been recently inside the confines of social media that some originators have taken the “Five Star Review” as serious and their units and dollar volume. With the huge amount of demand for loans, some have forgotten about the quality of the client experience and have been happy to just close the loan. In fact, some have actually told clients and referral partners that they should be happy to have been able to close at all! Scary but true! What I have always tried to share with my clients and those I am able to speak to is that the quality of the client and referral partner experience is “JOB #1”. Many have heard me say “the rate isn’t great if the closing is late” dozens of times. It has never been truer but also it has never…

Why is it that some people close 5 or 10 loans a month and look frazzled, exhausted, and on the verge of a breakdown; and others close the same number of units or more, and make it look effortless? I know most of you are going to say, they have an assistant, or a better processor, or stronger company support! While some of that may be true; I know many originators that close 10 or more units a month and do it in less than 40 hours a week. I have some who do have help, and seamlessly close 15, 20, or more units per month in the same time frame.

Agent Resource

|

||||||

What's New

From buying and selling advice for consumers to money-making tips for Agents, our content, updated daily, has made Realty Times® a must-read, and see, for anyone involved in Real Estate.

![Got Chronological Documentation In Your Files For All Your Transactions For Several Years? If You Get Into Issues With The Dre That Will Be One Of The First Things They’ll Want–be Sure Your Agents Are Posting Documentation To Be Safe Not Sorry[VIDEO]](/media/k2/items/cache/ed5815c322bbb25c0512699350a33103_S.jpg)

![Cyndi Garza Is The Creator Of Her Own Podcast Series: ”Optimized Success” This Podcast Program Looks To Successful Women In Other Industries Who Share Their Experiences. Her Newest Series Coming Up Is Faith & Success. Tune In And Learn More! [VIDEO]](/media/k2/items/cache/756dc4517ce3cc3e069cb0527054f56d_S.jpg)

![Tami Bonnell Is One Of The Top “C” Suite Women CEOs Heading Up EXIT Realty Where She Leads Over 25k Agents! She Shares Her Legendary Leadership That's Built On A Powerful Core Culture That Is Focused On Helping People To Be Their Best Selves [VIDEO]](/media/k2/items/cache/dc4f24b32a54f9ab643d1520f5ce739a_S.jpg)