During the Great Depression, the United States experienced a wave of bank failures that shook the nation's financial system to its core. Between 1929 and 1933, over 9,000 banks failed, wiping out the savings of millions of Americans. The root cause of these failures was a combination of factors, including a speculative stock market bubble, an overextended credit market, and a lack of regulatory oversight. Banks had invested heavily in the stock market, which was artificially inflated by speculation and fraud, and they had also loaned large amounts of money to investors who were unable to repay their debts. When the market crashed in 1929, many banks were left with bad loans and depleted reserves, and the ensuing panic led to a run on the banks. Customers withdrew their deposits en masse, causing banks to become insolvent and leading to a cascade of failures. This banking crisis intensified the economic downturn and contributed to the severity and duration of the Great Depression. In response, the Glass-Steagall Act was passed to prevent similar crises from occurring in the future.

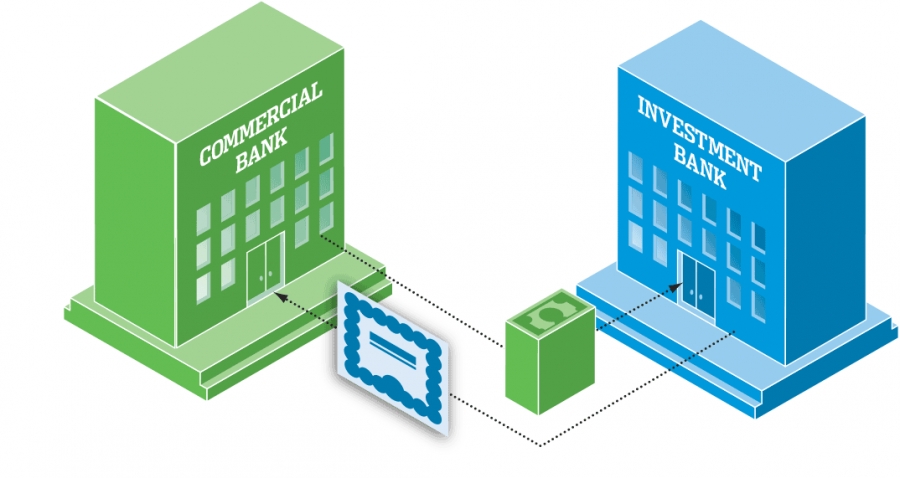

Glass-Steagall was a landmark piece of financial regulation that aimed to prevent banks from engaging in speculative activities that put depositors' money at risk. The Act was passed in 1933 and was named after its co-sponsors, Senator Carter Glass and Representative Henry B. Steagall.The Act separated commercial banks from investment banks, prohibiting commercial banks from engaging in investment banking activities and investment banks from taking deposits. This separation was intended to prevent banks from taking excessive risks with depositors' money, protect consumers from bank failures, and promote financial stability.

For many years, the Glass-Steagall Act was seen as a cornerstone of financial regulation. However, in the 1980s and 1990s, the banking industry began to push for the Act's repeal. They argued that the Act was outdated and prevented banks from competing effectively in a rapidly changing financial landscape.In 1999, the Gramm-Leach-Bliley Act was passed, which repealed key provisions of the Glass-Steagall Act and allowed banks to engage in a wider range of activities. This integration of commercial and investment banking paved the way for the creation of massive financial conglomerates.

While the repeal of Glass-Steagall had some benefits, such as allowing banks to offer more comprehensive financial services and promoting competition, it also had significant drawbacks. One of the most significant risks of the repeal was the increased risk of financial instability. Banks engaged in risky and speculative activities like subprime lending and securities trading, which led to the collapse of several major financial institutions and a widespread economic recession. Even in 2023, institutions like Silicon Valley Bank lost billions in customer deposits due to risky investments.

Reinstating the Glass-Steagall Act could limit the range of services that banks can offer, but it would promote a more stable and fair financial system. While it may require sacrificing some freedoms of choice as consumers, it would also protect consumers from the consequences of bank failures and prevent banks from prioritizing profits over the welfare of their customers.

Furthermore, the integration of commercial and investment banking has led to a reduction in diversity within the financial industry, as larger banks dominate the market and smaller banks struggle to compete. This lack of diversity can be detrimental to consumers, who may have fewer choices when it comes to banking and financial services.

Reinstating the Glass-Steagall Act could also promote competition within the financial sector, as smaller banks and financial institutions would have a better chance of competing with larger banks. This would prevent monopolies in the financial sector and create a more diverse and competitive industry, leading to better services and lower costs for consumers.

Finally, the reinstatement of the Glass-Steagall Act could help restore public trust in the financial system. The financial industry has been plagued by scandals in recent years, which have eroded public trust and led to calls for greater regulation. Reinstating Glass-Steagall would demonstrate the government's commitment to preventing another financial crisis and protecting consumers' interests, holding the financial industry accountable and creating a fair and stable financial system.

Glass-Steagall was a crucial piece of financial regulation that aimed to prevent another financial crisis like the Great Depression. The repeal of the Act allowed banks to offer more comprehensive financial services and promoted competition, but it also increased the risk of financial instability, reduced diversity in the industry, and led to banks prioritizing profits over the welfare of their customers. Reinstating the Act could limit the range of services that banks can offer, but it would promote a more stable financial system, prevent monopolies within the industry, and restore public trust in the financial system.