Investing in real estate opens up many opportunities not only for increasing wealth but also for financial security. That’s why investing in this area is attractive for both experienced investors and beginners.

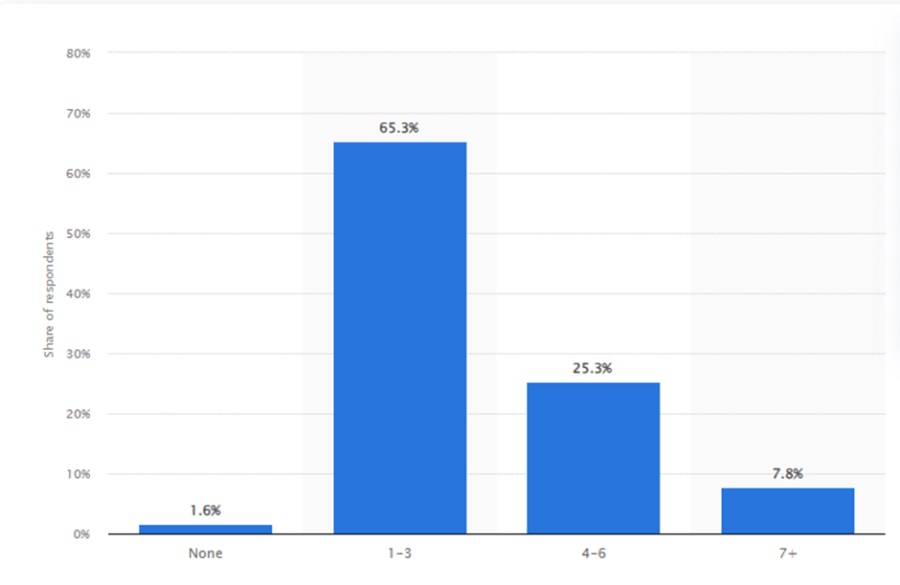

In 2022, Statista surveyed 1100 US real estate investors, and most planned to invest in commercial real estate. At the same time, multifamily home insurance received the largest share of investments.

Source: Statista

Although the total value of the world’s property decreased in 2022 (compared to 2021) by 2.8% for a number of reasons, the industry is still attractive to investors.

How are insurance and property investments connected, and what do you need to consider when deciding to invest in real estate? Here’s an article on this topic, prepared by American Reia specialists.

What Are Insurance Options for Investors?

Most companies with activities are related to real estate investments have common methods that allow them to determine what type of coverage for investment properties may be needed.

However, with a variety of options, it is important to study all available ones so as not to make a mistake and choose the most effective one in a particular case. Let's look at the most common types of insurance planning for real estate.

General Liability

Source: Professional Insurors

The fundamental and most popular type of insurance for all real estate investors. The reason for this is the scale of insurance coverage. General liability can protect your investments from a whole range of insurance risks. These include personal injury, as well as property damage and legal costs for third-party claims.

For example, if a visitor in your building slips on a wet floor and is injured, general liability insurance will cover the cost of medical care.

Commercial Property Insurance

This type protects the company's structures, buildings, and other tangible assets from incidents such as vandalism, theft, fire, hurricanes, burst pipes, etc. Let's say a fire breaks out in a warehouse, causing significant property damage. Commercial property insurance pays for the cost of repairing the premises as well as replacing destroyed inventory.

This policy provides coverage for three types of real estate:

1. A building you own or for which you are responsible, including insurance. Coverage includes commissioned extensions, external and internal fixtures, as well as permanently installed equipment and machinery.

2. Property of your business or, in other words, what is in the building itself and within a 100-foot radius of it. This could be furniture, inventory, equipment, etc.

3. Private property of others under your responsibility and control. This includes borrowed property as well as the client's property located both within the building and within 100 feet of it.

Source: SketchBubble

The scope of coverage under this type of policy makes it a profitable solution for real estate investors.

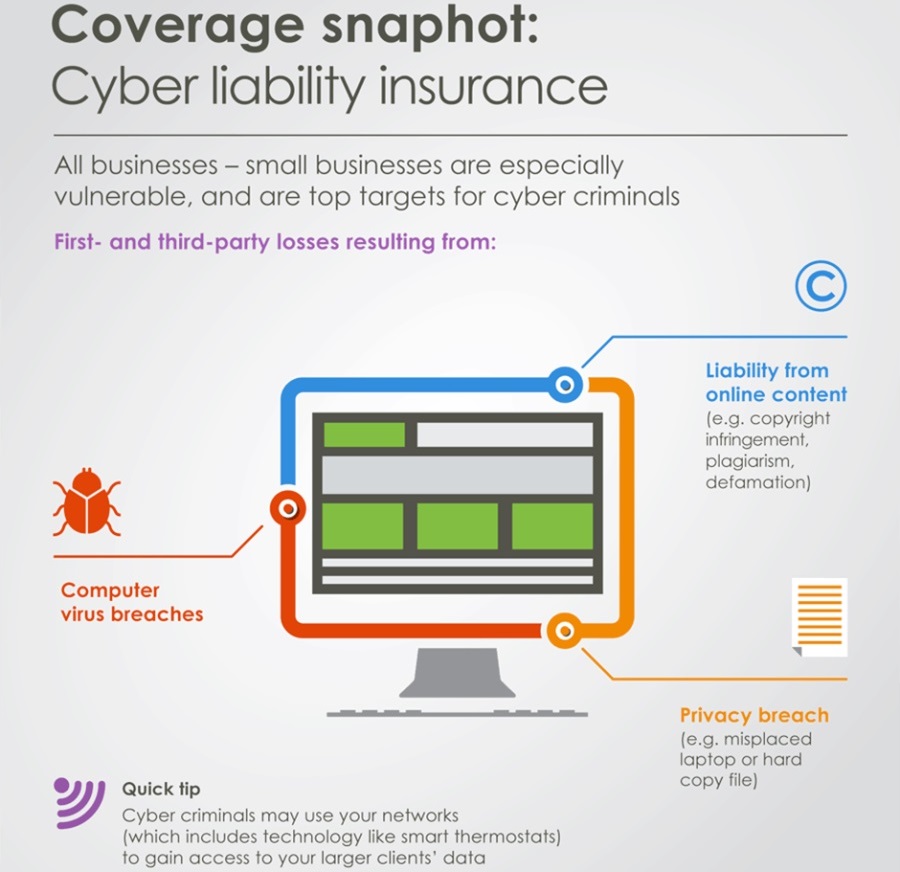

Cyber Liability

Source: TruShield Insurance

Cyber threats are becoming more and more fanciful and aggressive. At first glance, you might not even guess what message they carry. Their development was especially affected by the pandemic, which forced almost the entire workforce to switch to remote work. Alas, no one is safe from ransomware.

Cyber liability insurance can protect a real estate investor both from real leaks of confidential data and from alleged cyberattacks aimed at computers serving the business.

For example, a hacker has gained access to your property's tenant database and reveals confidential information about them. The role of insurance is to compensate for the costs caused by the response to the violation, as well as legal costs and notification materials.

Workers Compensation

Source: QuickBooks

This kind is particularly useful for real estate investment companies hiring staff. Employee insurance is required everywhere, and in some cases, it is necessary even for independent contractors.

It covers medical expenses and compensation for lost wages associated with an employee's work-related injury. For example, if a company employee falls and breaks their leg, workers' compensation insurance will cover hospital bills, physical therapy, lost income, and related expenses.

The main advantage of this type of insurance for property managers: if your company has such a policy and an employee files a lawsuit, the process does not go through the civil court, but through the workers' compensation system. This way, you are protected from crime and fix the amount of annual compensation for injuries.

Liability Umbrella

Source:

Owning real estate always comes with risks as investors manage multiple buildings, supervise workers, and comply with laws and regulations. This is especially challenging in unpredictable environmental and economic circumstances. Most home equity insurance policies are capped at $1 million per case, so you may need additional protection.

Part of risk management in real estate falls under a liability umbrella, also called an excess liability policy. As a rule, it comes as an addition to the main insurance policy, expanding the scope of coverage. A liability umbrella policy is essential for real estate investment companies with significant assets and risks.

How it works? The Umbrella policy comes into effect when the total liability limit is reached. Consider the situation: a tenant's child is injured on the premises, and the property owner is sued for $3 million. In this case, the general liability policy will cover the $1 million limit, and the umbrella policy will cover the $2 million limit.

Legal Liability of the Tenant (For Investors in Residential Sectors)

This type of insurance provides great benefits to real estate investors since it compensates for the amount of damage the tenant causes to the property they lease. Also, insurance for landlords protects all participants in the process.

Such insurance can cover various issues that may arise on the territory of the rental building. This includes damage caused by pets, flooding due to plumbing problems, and so on. Landlord liability insurance also covers loss of rental income.

Investors often encounter difficulties when purchasing insurance for real estate investors, as they try to cover as many insurance conditions and building options as possible. For this reason, it is important to explore each option of real estate coverage to be 100% protected.

Useful Tips for Choosing a Policy: Investor's Insurance Guide

Choosing the wrong property insurance in the future can play a cruel joke on the investor. For example, in the event of a natural disaster, the insurance will not be enough to compensate for the damage, or the investor will overpay a significant amount for additional conditions that are actually unnecessary.

Here are a few recommendations that will certainly be useful to both novice and experienced investors:

1. Consider the price order. Be prepared that insurance for rental homes and buildings is more expensive than for owned ones. For this reason, unscrupulous investors do not inform insurance companies that the property is for rent. However, if this information is disclosed, the policy may be voided, and this person must pay claims out of their pocket.

2. Check the actual cash value vs. replacement cost. Actual cash value (ACV) means that the insurance company pays you the value of your property minus the price of the land. Replacement cost is a comprehensive property damage coverage, even if it is restored. If you rent out your property, regularly review price trends before renewing your policy to ensure you have full rental property coverage.

3. Research the types of policies. Real estate insurance solutions are divided into 3 main types: Builder’s Risk for a house undergoing a major rehab, Vacant for a property you are renovating, and Landlord for rented property. If you have just completed the renovation of a property and are going to rent it out, be sure to update your insurance policy. It would be a good idea to ask your insurance broker about additional compensation for lost rent, tenant liability, etc.

4. Take advantage of the franchise. This is the amount you will have to pay if a claim is filed. Franchises offered by insurance companies help reduce claims that policyholders may make. Typically, the higher your insurance franchise, the lower your annual premium will be.

5. Get discounts on your policy. Ask the insurance company you applied for tech insurance or car policy if they provide property insurance services for investors. Complex asset protection insurance often comes at a nice discount for the client.

Final Thoughts

Choosing the right option among insurance strategies for your real estate can protect you from unexpected and significant financial losses, significantly saving you money.

It is essential to understand the types of insurance policies before making a decision: this will ensure reliable securing of your real estate portfolio in the future.