|

Monday Morning Quarterback

(Happy Memorial Day)

Last month I wrote about the buildings in Los Angeles that are vulnerable in an earthquake. But San Francisco has it worse! Much worse! Famous historic sites, low-income apartments, even Twitter's headquarters all appear on a previously unpublished draft list of 3,407 concrete buildings in San Francisco that are at high risk of collapse in a major earthquake. The list is an undisclosed city government document obtained by NBC News through a public records request. The list provides a window into the sweeping cross section of San Francisco that could be seriously vulnerable in a high-magnitude earthquake. Retrofitting the buildings (so that they’re deemed safe) could require billions of dollars and decades of work, structural engineers admit. Thousands of people who live or work in these buildings are taking on additional risk every time they step inside — and many of them don’t know their buildings are on the list because the city hasn’t decided when it will send out official notices. The city official overseeing production of the list expressed concern that publishing it could prematurely cause uneasiness among tenants, investors and others before building owners have a chance to do thorough evaluations. The report’s actual content has never been published before. A city website said the city had “created an inventory of concrete buildings,” although someone removed that mention after an NBC News reporter requested a copy. The list excludes single-family homes, public schools and buildings constructed after 2000. Structures on the current list have one thing in common: They were built with concrete at a time before engineers fully understood how much steel or other reinforcement was needed to keep the concrete from crumbling while shaking. The concrete (referred to as “nonductile concrete,”) breaks rather than bends in response to stress. In other disconcerting real estate news, let get under the hood…

New Single-Family Home Sales Increased in April. New single-family home sales increased 4.1% in April to a 0.683 million annualized rate. Sales are up 11.8% from a year ago. New home sales continue to recover, signaling that activity may have hit at least a temporary bottom back in mid-2022. While sales are on an upward trend and are now up 25.8% from the low in July of last year, they still remain well below the pandemic highs of 2020. As you know, the main issue with the housing market has been declining affordability. Assuming a 20% down payment, the jump in mortgage rates and home prices in just the past year amounts to a 13% increase in monthly payments on a new 30-year mortgage for the median new home. With 30-year mortgage rates currently sitting near 7.0%, financing costs remain a headwind for buyers. However, the median sales price of new homes has fallen by 15.3% from the peak late last year, which has helped sales activity begin to recover. Notably, while a lack of inventory had contributed to price gains in the past couple of years, inventories have made substantial gains recently. For example, the months’ supply of new homes (how long it would take to sell the current inventory at today’s sales pace) is now 7.6 months, up significantly from 3.3 months early in the pandemic. Most importantly, the supply of completed single-family homes has more than doubled versus a year ago. This is in contrast to the market for existing homes which continues to struggle with an inventory problem due to the difficulty of convincing current homeowners to give up the low fixed-rate mortgages they locked-in during the pandemic.

|

|

|

Growth Plan Will Transform DTLA. In Los Angeles, perhaps the only thing that takes longer than actually building a house is getting a project approved. Worse, attempt to secure a green light for an entire “Community Growth Plan,” and the wait becomes Godot-like. That’s why a pair of approvals in City Hall last week were seriously monumental: The Los Angeles City Council voted 13-0 in favor of plans that will guide greatly expanded residential development in Hollywood and Downtown. The city has 34 community plans intended to shape development that fits the unique characteristics of each neighborhood—which uses are most appropriate (residential, commercial, industrial or a mix). Ideally they should be updated regularly to reflect ongoing changes in a neighborhood. But in practice usually aren’t—the last time a community plan was approved for Hollywood was, gulp, 1988. Hollywood actually had a plan approved in 2013 but after opposition a judge shot it down, forcing everyone back to the drawing board. The new vision just passed for Hollywood calls for the addition of 35,000 housing units. That’s big, but the Downtown plan, also known as “DTLA 2040,” is even bigger. A building boom that started at the turn of the millennium has already seen the area grow from around 18,000 residents to more than 75,000 today. DTLA 2040, meanwhile, prepares for the creation of 100,000 new housing units and the addition of 175,000 residents to an area where office vacancies have thrown the area into an identity crisis. State guidelines require Los Angeles to add 455,000 housing units, including 185,000 affordable residences, by 2029. Downtown’s central location, access to transit and the necessity to build vertically when so much of L.A. sprawls horizontally makes it ideal for future high-density residential development. The Fashion District, Skid Row and Chinatown also stand to benefit from the new plan, which includes provisions for preserving businesses and allowing low-income residents to live near their jobs. So will developers, who will not only have more property on which to build, but streamlined permitting where before rules could vary from block to block across downtown.

|

|

|

More Cities Giving Away Money For Office-To-Residence Projects. Falling tax revenue. Aging downtowns losing their vitality. Record office vacancy. A housing crisis. One strategy could tackle all of these problems in one fell swoop: a wave of office-to-residential conversions. Developers are interested, and the opportunities are there, with hundreds of millions of square feet of offices identified throughout the country as potentially feasible for conversion. But the cost to do these projects is too often prohibitive, and completed projects have been limited. But cities and states are starting to do something about it. Incentives aimed at encouraging office-to-residential conversions are gaining traction. From Chicago, which will make at least $197 million in tax increment financing dollars available to developers willing to convert old buildings to multifamily units, to a $400M program in California and a $2.5M tax abatement scheme in Washington, D.C., meant to achieve the same end, cities and states in the U.S. have introduced programs at the behest of developers who say the math doesn’t work without public funds. The pace of office conversions accelerated across the U.S. last year, according to CBRE, but the process has only taken a minuscule bite out of supply thus far. The 218 conversions completed across the U.S. from 2016 to 2022 combined with the 217 projects in the pipeline in 2023 amount to only 2% of the national office stock. And CBRE reports many of the pipeline projects will “fall prey to financing shortfalls or regulatory issues” and never see the light of day. On the West Coast, California set aside $400M in incentives to convert office buildings to affordable housing. As of early March, more than 50 developers and investors had applied for the funding, according to CoStar. Even smaller-population cities like Long Beach, California (the nation's 42nd-most-populous metro), have looked at tax incentives to convert office space into housing. Conversions can cost anywhere from $250 per SF to $350 per SF, which is the cost of a new build in some markets. In the past, developers have opted for conversions because they can be done more quickly and the demand for residential outweighs that for office.

Little-known Neutra Rehab Goes From Gutted to Glam. In a city with no shortage of noteworthy Midcentury Modern homes, rehabbers Erik Amir and Dora Chi were surprised when they stumbled upon a listing for a little-known Los Angeles house by Richard Neutra. The husband-and-wife team were renting in Studio City while designing their dream home when they received an invitation to tour what the Realtor described as “a lost Neutra in very bad condition.” The agent wasn’t exaggerating. As architects, they couldn’t resist the opportunity to tour a project by one of Southern California’s first starchitects. But when they entered the 3,800-square-foot house in Sherman Oaks, they found it gutted and uninhabitable. “There was no electrical. No water. The only thing that was nice was a table with original sketches by Neutra along with a piano belonging to the home’s original owner, Stephen Lord. That was it.” Despite its damaged state, Neutra’s trademark geometry of glass and wooden beams, open interiors and an easy connection to the outdoors were apparent.“ The team made an offer immediately, and it was accepted after they promised to restore the home to its original glory. According to public records, the couple paid $1.95 million for the house in October 2021. Chi and Amir, who are partners in the architecture firm Spatial Practice, brought their professional experience to the project during the renovation process, which started Nov. 21, 2021, and took 16 months. They restored the floating fireplace as designed by Neutra and they also toured several Neutra homes in Los Angeles, including the Chuey and Lew houses in the Hollywood Hills and Neutra’s personal residence, the VDL House in Silver Lake. When finished, they decided to live in the home themselves. Asked what it’s like to live in a home designed by another architect, Amir is philosophical. “Each day, we are reminded of how the basics of good spatial architecture is essential, from the way the house is oriented, the spatial planning, the scale and proportions of each space and the relationship to nature,” he says. “We often have conversations with clients where we explain that good architecture is about going back to the essence of architecture, and it is so clearly in this house.”

|

|

|

The Ugly Truth Behind “We Buy Ugly Houses” (Part 1). ProPublica just published an investigative report on HomeVestors (the “We Buy Ugly House” franchise) and it ain’t pretty. In fact, it is downright “ugly.” The ProPublica investigation (based on court documents, property records, company training materials and interviews with 48 former franchise owners and dozens of homeowners who have sold to its franchises) found HomeVestors franchisees use deception and targeted the elderly, infirm and those so close to poverty that they feared homelessness would be a consequence of selling. Bottom of FormHomeVestors of America boasts that it helped pioneer the real estate investment industry. Founded in 1996 by a Texas real estate broker, the company developed a system for snapping up problem properties — and expanded it to nearly 1,150 franchises in 48 states. HomeVestors proclaimed itself “largest homebuyer in the United States,” which, of course, isn’t true. The company says it helps homeowners out of jams (ugly houses and ugly situations) improving lives and communities by taking on properties no one else would buy. Part of that mission is a promise NOT to take advantage of anyone who doesn’t understand the true value of their home, even as franchisees push rock-bottom prices. But the reality is quite different. When homeowners inevitably discovered they were taken advantage of and tried to cancel the deal, franchisees systematically sued or filed paperwork to block a sale to another buyer. Some homeowners fought from hospital beds to keep their properties. At least three died shortly after signing sales contracts; a fourth died after three years of worrying about money. Their families told ProPublica that they are convinced the stress of losing their houses contributed to their loved ones’ deaths. And ProPublica discovered more…

|

|

|

We Buy Ugly Houses (Part 2). Within days of receiving questions from ProPublica, HomeVestors suddenly prohibited its franchisees from recording documents to prevent homeowners from canceling sales and discouraged them from suing sellers. The practices not only affect the seller, the company noted, it creates “a paper trail that reporters and prosecutors can follow to a franchise’s doorstep.” In fact, in recent years, scores of homeowners have complained to local authorities and the Federal Trade Commission about HomeVestors’ ceaseless maneuvers — sometimes claiming that the company ignored formal requests to stop. In a written statement, the HomeVestors spokesperson initially denied the company targets homeowners based on such life events as a death, divorce or moving to a nursing facility. But after ProPublica pointed to company advertising documents and training materials that teach such tactics, the spokesperson shifted gears and argued they represent only a small fraction of its marketing budget. The company also denied targeting homeowners based on demographics, including age. Rather, the company focuses on smaller, older properties that may be in need of repair, the spokesperson said. Regardless, ProPublica found a pattern of HomeVestors franchisees facing allegations they deceived homeowners in pursuit of deals. Its spokesperson also said the company does not target elderly homeowners, adding that people over 70 accounted for less than 20% of its sellers. But ProPublica exposed that nearly a third of their purchases are from people older than 65. It is common for many HomeVestors franchises to file lawsuits when owners try to cancel a sale, or to record a lis pendens or similar documents (termed “clouding a title”) as a way to tie an owner to a deal. ProPublica found more than 50 franchisees clouding titles or suing for breach of contract regularly in more than a dozen states. (Though getting an accurate count is difficult because disputes are often settled confidentially through arbitration.) Others, including some franchises recognized by HomeVestors as top performers, frequently clouded titles. If you want to read the whole report, go to www.ProPublica.org.

Burbank Has Gigantic Castles. Why are there castles in Burbank? The answer to that question leads us to Gary Bandy. Bandy, who died at 80 from cardiovascular problems in October 2021, transformed his family’s Burbank-based business “from a million- dollar-a-year company into a $14-million-a-year company,” said Brett Bandy, one of Gary’s 11 children. He was intensely creative, not content to simply dot Burbank’s streets with bland, box-like commercial buildings. Instead, he aimed to leave a legacy behind in the city he loved. But before this developer built castles, he made a fortune doing something slightly less whimsical: supplying specialized parts and hinges for the aerospace industry. Over the years, Bandy reinvested profits into real estate development. He built various residential, industrial and commercial buildings — dressing some of them up as castles along the way. But where did Bandy’s castle inspiration come from? His upbringing in L.A. County certainly played a role, said Greta Bandy, Bandy’s widow. Born at Hollywood Presbyterian Medical Center and raised in the San Fernando Valley, Bandy was “a California boy through and through.” “He was a very romantic individual, and I think Hollywood has so much to do with that,” she said. “The whole idea of Camelot really stuck with him.” Bandy also longed to leave a tangible mark on the Burbank community. “Burbank brought him wealth, Burbank was a spot where he found joy, where he was successful. And so he wanted to...leave some sort of legacy,” said son Garrett Bandy. Given Burbank’s significance in the film industry, “He thought, ‘Why don’t I [build] these castles?’” Garrett said. Conveniently, building castles doesn’t need to cost significantly more than constructing your average building — at least not the way Bandy and his team approached it. “You only needed to modify walls a little bit and put on some extra characteristics that weren’t that much more expensive than a regular block building,” Brett said. One by one, Bandy (along with close collaborators, such as general contractor Henrik Oakland) brought the castles to life.

|

|

|

Save the Boat Houses. One of Encinitas’ most prized historic landmarks are the boathouses, the S.S. Encinitas and the S.S. Moonlight. Built by architect Miles Kellogg, the boathouses were constructed from salvaged lumber sourced from the old Moonlight Beach bathhouse and a hotel that failed to survive the Prohibition’s dry years. The boathouses exemplify what has come to be known as early California “courtyard architecture” as well as the kind of vernacular design associated with Historic Highway 101. Each house is 15 feet tall by 20 feet long and have a breathtaking stature when face-to-face with them. They are quite possibly one of the most photographed attractions in Encinitas. In order to protect this downtown gem, a partnership was forged with the Encinitas 101 MainStreet Association and the Encinitas Historical Society to purchase the boathouses in 2008 with a $1.55 million loan. The entire purchase included the boathouses, along with a four-unit apartment complex on the property. The additional four-unit complex is part of the City of Encinitas’ low-income housing program. With the help of donations, rent and community partners, the EPA has since poured thousands of dollars into restoring the boathouses. The Association was also able to put the boathouses on the map by including it on the National Registry of Historic Places in 2019. This step has allowed the Association to ensure the protection of the boathouses for generations to come.

|

|

|

Saying of the Week. “Twenty years from now you will be more disappointed by the things that you didn’t do than by the ones you did do. So throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover.” Mark Twain

“An Evening with Brad Sumrok.” When it comes to multi-residential properties, there is no one more experienced and popular than Brad Sumrok. Visiting us from Dallas, Texas, Brad is the number #1 authority on finding, evaluating, buying, financing, and managing apartment buildings. Every year his presentation is the most attended of all our meetings. Brad will be our special guest at LAC-REIA’s June 8, 2023 meeting, at the Iman Cultural Center, 3376 Motor Avenue (between National and Palms), Los Angeles, 90034 (Culver City adjacent). FREE Admission. RSVP at www.LARealEstateInvestors.com.

|

|

|

Vendors Expo Returns! Our carbon-neutral, bio-degradable, gluten-free, super-duper "Vendors Expo" returns on Thursday night, June 8, 2023. The Vendor Expo opens at 6:30 pm. We'll have 40+ of the finest vendors featuring real estate products and services you will want to utilize as a successful investor. Iman Cultural Center, 3376 Motor Avenue (between National and Palms), Los Angeles, CA 90034 (Culver City adjacent). FREE Admission. Please RSVP at www.LARealEstateInvestors.com.

|

|

|

|

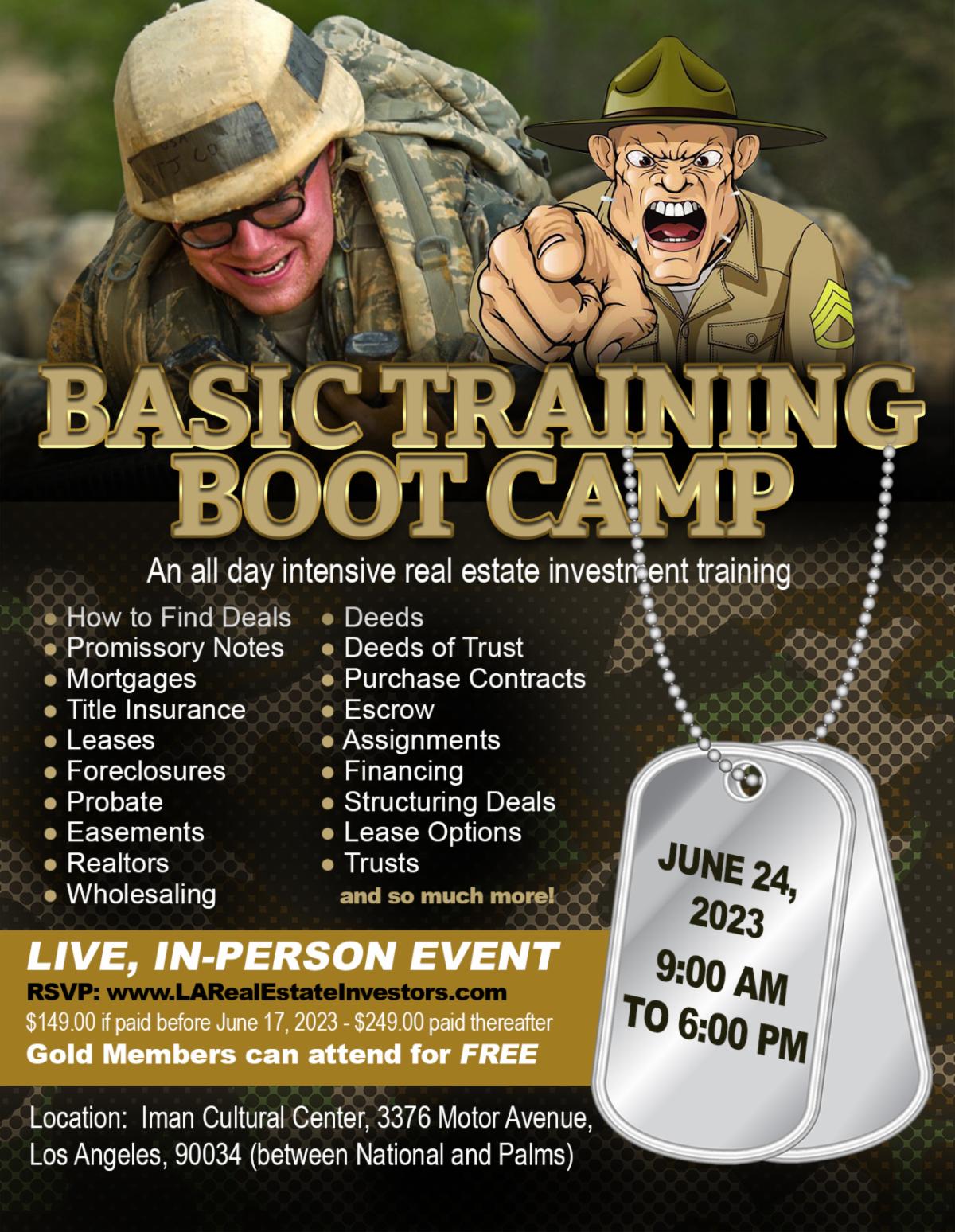

Basic Training Boot Camp. Saturday, June 24, 2023, 9:00 am to 6:00 pm, will be our semi-annual Basic Training Boot Camp. Everything you ever wanted to know about real estate investing but were afraid to ask. Iman Cultural Center, South Hall, 3376 Motor Avenue (between National and Palms), Los Angeles, 90034.The cost of the Boot Camp is $149.00 per person, if paid before June 17. After June 17, the price jumps to $1 million per person. So don’t wait to register. (Gold Members and former Boot Campers can attend for FREE, but still need to register.) You can register at LARealEstateInvestors.com.

|

|

|

|

Parking. Recently attendees have commented about the lack of parking. But fear not. If there is no available street parking when you arrive, there are two FREE parking structures just two blocks away. The first structure is at the northeast corner of Motor and Palms. The second structure is at the northeast corner of Motor and National. From either lot it is short two blocks walk to the Iman.

“LARealEstateInvestors.com” Podcast. We are so very excited to announce our new podcast, "LARealEstateInvestors.com" (named after our domain) hosted by our very own Bill Gross. Bill has been a Realtor, broker and real estate investor forever! No one is more experienced in local Southern California real estate than Bill Gross. Each week, Bill interviews real estate professionals sharing their insights and advice for real estate investors. Every Tuesday live at 3:00 pm, and anytime thereafter on YouTube, Facebook, and Google.

This Week. Investors will continue to keep a close eye on the debt ceiling negotiations and banking sector troubles. They will also watch to see if Fed officials elaborate on their plans for future monetary policy. For economic reports, the Institute for Supply Management’s National Manufacturing Index will come out on Thursday. The key Employment report will be released on Friday by the Labor Department, and these figures on the number of jobs, the unemployment rate, and wage inflation will be some of the most highly anticipated economic data of the month. Mortgage markets will be closed today in observance of Memorial Day.

Weekly Changes:

10-year Treasuries: Rose 015 bps

Dow Jones Average: Fell 500 points

NASDAQ: Rose 100 points

Calendar:

Wednesday (5/31): JOLTS

Thursday (6/1): ISM Manufacturing

Friday (6/2): Employment

|

|

For further information, comments, and questions

Lloyd Segal

President

Los Angeles County Real Estate Investors Association, LLC

www.LARealEstateInvestors.com

This email address is being protected from spambots. You need JavaScript enabled to view it.

310-409-8310

|

|

|

|